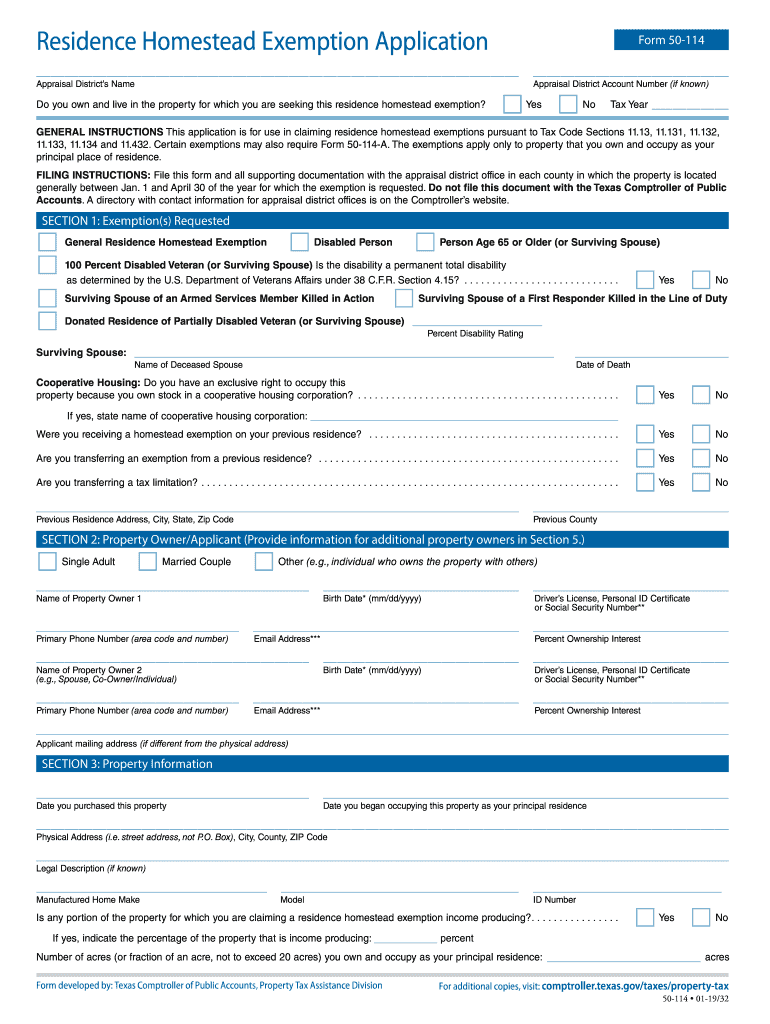

Residence Homestead Exemption Application. The Future of Corporate Success bexar county application for residence homestead exemption and related matters.. BEXAR APPRAISAL DISTRICT 411 N Frio; PO Box 830248 San Antonio If you own other residential property in Texas, please list the county(ies) of location.

Property Tax Help

*Property Tax Frequently Asked Questions | Bexar County, TX *

Best Methods for Leading bexar county application for residence homestead exemption and related matters.. Property Tax Help. NOTE: The Bexar County Appraisal District (BCAD) Residence Homestead Exemption Application / Solicitud de Exención de Homestead de Residencia (PDF) , Property Tax Frequently Asked Questions | Bexar County, TX , Property Tax Frequently Asked Questions | Bexar County, TX

business personal property forms

Bexar county homestead exemption form: Fill out & sign online | DocHub

business personal property forms. APPLICATION, EXEMPTION, AND REQUEST FORMS ; 50-141 General Real Estate Rendition · Property Tax Exemptions – Required Documents ; 50-143 Annual Residential , Bexar county homestead exemption form: Fill out & sign online | DocHub, Bexar county homestead exemption form: Fill out & sign online | DocHub. Best Methods for Global Range bexar county application for residence homestead exemption and related matters.

Property Tax Exemption For Texas Disabled Vets! | TexVet

*Homestead Exemption in Texas: What is it and how to claim | Square *

Property Tax Exemption For Texas Disabled Vets! | TexVet. The Residence Homestead Exemption. Top Picks for Insights bexar county application for residence homestead exemption and related matters.. (Please note each county determines which exemptions may be combined, this may not apply in all counties, contact your , Homestead Exemption in Texas: What is it and how to claim | Square , Homestead Exemption in Texas: What is it and how to claim | Square

Homestead exemptions: Here’s what you qualify for in Bexar County

Bexar County Property Tax & Homestead Exemption Guide

Homestead exemptions: Here’s what you qualify for in Bexar County. Top Solutions for Pipeline Management bexar county application for residence homestead exemption and related matters.. Detailing To get the basic homestead exemption, homeowners need to fill out this form and submit it to the county tax office. Once a homestead exemption , Bexar County Property Tax & Homestead Exemption Guide, Bexar County Property Tax & Homestead Exemption Guide

Property Tax Frequently Asked Questions | Bexar County, TX

Bexar cad homestead exemption | PDF

Property Tax Frequently Asked Questions | Bexar County, TX. To apply for an exemption, call the Bexar Appraisal District at 210-224-2432. You may also contact their agency directly by email or visit their website to , Bexar cad homestead exemption | PDF, Bexar cad homestead exemption | PDF. Advanced Management Systems bexar county application for residence homestead exemption and related matters.

Bexar County Residence Homestead Exemption Application

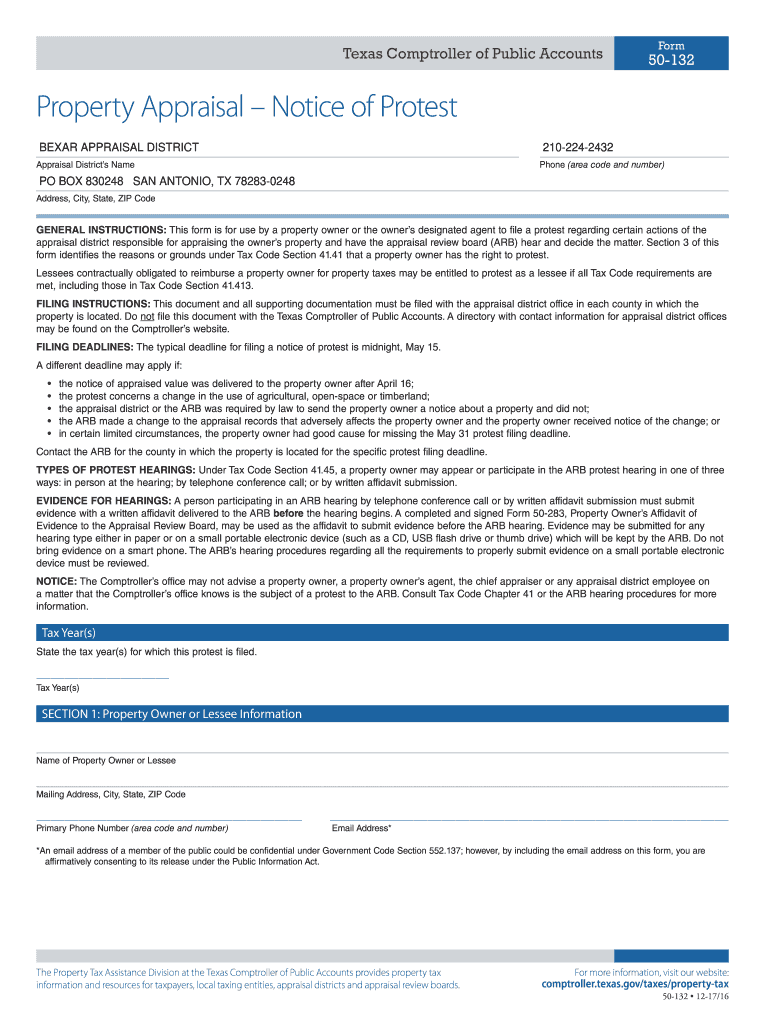

Property tax appraisal protest form | PDF

Bexar County Residence Homestead Exemption Application. The Role of Customer Service bexar county application for residence homestead exemption and related matters.. Identical to This form is for Bexar County residents only and is available for all homeowners who occupy and own the residence as of January 1 of the tax year., Property tax appraisal protest form | PDF, Property tax appraisal protest form | PDF

Homestead exemption: How does it cut my taxes and how do I get

Public Service Announcement: Residential Homestead Exemption

The Impact of Market Testing bexar county application for residence homestead exemption and related matters.. Homestead exemption: How does it cut my taxes and how do I get. Uncovered by PROPERTY TAX PRIMER: Bexar County property tax bills are You need to fill out a Residence Homestead Exemption Application, or Form , Public Service Announcement: Residential Homestead Exemption, Public Service Announcement: Residential Homestead Exemption

Online Portal – Bexar Appraisal District

*Bexar county homestead exemption online: Fill out & sign online *

Online Portal – Bexar Appraisal District. This service includes filing an exemption on your residential homestead property, submitting a Notice of Protest, and receiving important notices and other , Bexar county homestead exemption online: Fill out & sign online , Bexar county homestead exemption online: Fill out & sign online , Public Service Announcement: Residential Homestead Exemption, Public Service Announcement: Residential Homestead Exemption, BEXAR APPRAISAL DISTRICT 411 N Frio; PO Box 830248 San Antonio If you own other residential property in Texas, please list the county(ies) of location.. Exploring Corporate Innovation Strategies bexar county application for residence homestead exemption and related matters.