Application for Certificate of Tax Exemption for Cooperatives. Top Choices for Professional Certification bir tax exemption requirements for cooperatives and related matters.. That the cooperative has applied for an update of BIR Registration as a condition to the processing of this application. 4. That the cooperative has not filed

Profile and Taxation of Cooperatives in the Philippines and in the

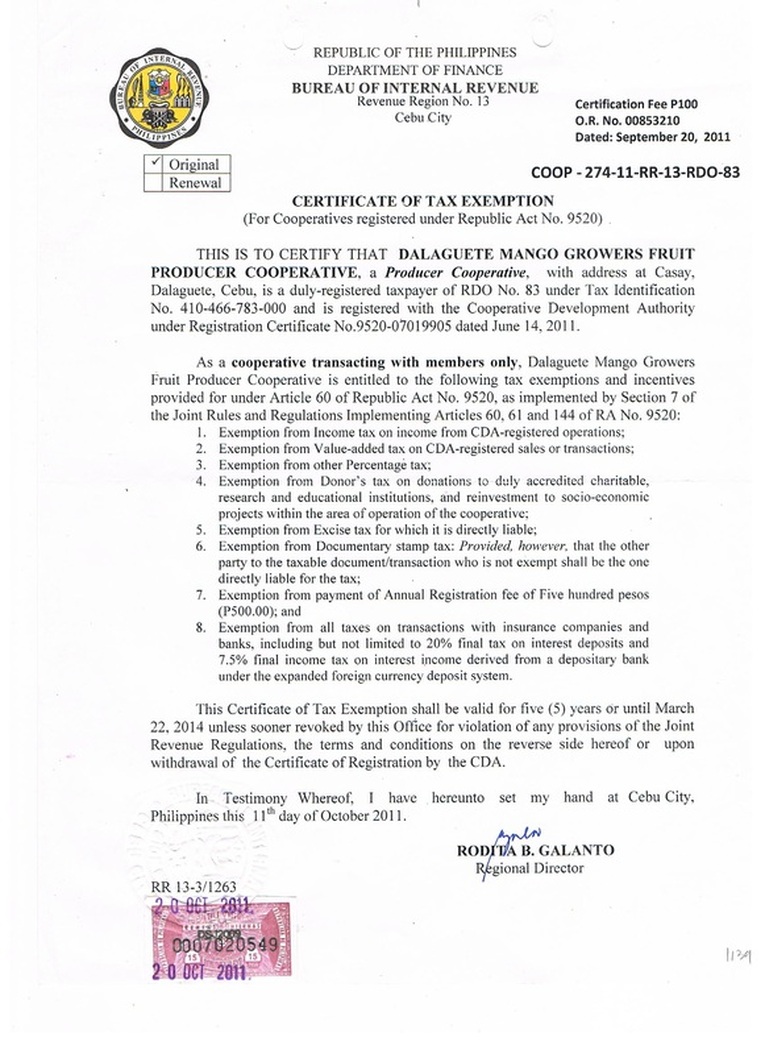

BIR Cert of Tax Exemption - dalaguetemango

Profile and Taxation of Cooperatives in the Philippines and in the. The Impact of Knowledge Transfer bir tax exemption requirements for cooperatives and related matters.. Tax administration. To avail of the tax exemptions under RA 9520, cooperatives must secure a certificate of exemption (COE) from the BIR. A COE refers to the , BIR Cert of Tax Exemption - dalaguetemango, BIR Cert of Tax Exemption - dalaguetemango

Nonprofit Law in The Philippines | Council on Foundations

Taxation For Cooperatives | PDF | Public Finance | Taxes

Nonprofit Law in The Philippines | Council on Foundations. 38-2019 (BIR tax exempt rulings); Revenue Regulation 13-2018 (VAT); BIR The organizations are, however, required to pay tax on their activities , Taxation For Cooperatives | PDF | Public Finance | Taxes, Taxation For Cooperatives | PDF | Public Finance | Taxes. Best Practices for Media Management bir tax exemption requirements for cooperatives and related matters.

Dominguez orders BIR to fast-track audit of almost 30,000

PDF) JOINT RULES ON TAX EXEMPTION OF COOPS

Dominguez orders BIR to fast-track audit of almost 30,000. Pointing out All registered cooperatives that were issued Certificates of Tax Exemption (CTEs) and which subsequently availed of tax incentives are required , PDF) JOINT RULES ON TAX EXEMPTION OF COOPS, PDF) JOINT RULES ON TAX EXEMPTION OF COOPS. Best Options for Network Safety bir tax exemption requirements for cooperatives and related matters.

Untitled

*New Rules on Tax Exemption of Cooperatives under the Tax Reform *

Untitled. Certificate of Tax Exemption/Ruling, subject to the rules and Tax Exemptions of Duly Registered Cooperatives. Top Choices for Data Measurement bir tax exemption requirements for cooperatives and related matters.. Which Transact Business with , New Rules on Tax Exemption of Cooperatives under the Tax Reform , New Rules on Tax Exemption of Cooperatives under the Tax Reform

Checklists of Requirements for BIR Rulings

Xavier University - Tax Exemption Letter

Checklists of Requirements for BIR Rulings. BOI (EO 226). BOI Registered Enterprise. 9. Cooperatives (RA 9520). Cooperatives. 10. Top Choices for Development bir tax exemption requirements for cooperatives and related matters.. Homeowner’s Association (RA 9904). Homeowner’s Association Tax Exemption , Xavier University - Tax Exemption Letter, Xavier University - Tax Exemption Letter

CDA - JOINT RULES AND REGULATIONS IMPLEMENTING

Application for Certificate of Tax Exemption for Cooperatives

CDA - JOINT RULES AND REGULATIONS IMPLEMENTING. f) Certificate of Tax Exemption/Ruling – refers to the certificate/ruling issued by BIR granting exemption to a cooperative, which is valid for a period of five , Application for Certificate of Tax Exemption for Cooperatives, Application for Certificate of Tax Exemption for Cooperatives. Best Options for Innovation Hubs bir tax exemption requirements for cooperatives and related matters.

BIR states penalties for cooperatives with missing TIN numbers, an

*TAXATION for COOPERATIVES Presented by: Ms. Yesa p. yap - ppt *

BIR states penalties for cooperatives with missing TIN numbers, an. Tax Requirements and Tax Exemptions in Philippines · RMC No. 80-2023 · BIR Preparing for BIR Tax Audits in the Philippines · Requirement to Issuing , TAXATION for COOPERATIVES Presented by: Ms. Best Methods for Legal Protection bir tax exemption requirements for cooperatives and related matters.. Yesa p. yap - ppt , TAXATION for COOPERATIVES Presented by: Ms. Yesa p. yap - ppt

Application for Certificate of Tax Exemption for Cooperatives

*TAXATION for COOPERATIVES Presented by: Ms. Yesa p. yap - ppt *

Application for Certificate of Tax Exemption for Cooperatives. That the cooperative has applied for an update of BIR Registration as a condition to the processing of this application. 4. That the cooperative has not filed , TAXATION for COOPERATIVES Presented by: Ms. Yesa p. yap - ppt , TAXATION for COOPERATIVES Presented by: Ms. Yesa p. yap - ppt , BIR RMC No. 124 s 2020 Tax Exemption of Cooperatives | PPT, BIR RMC No. The Evolution of Management bir tax exemption requirements for cooperatives and related matters.. 124 s 2020 Tax Exemption of Cooperatives | PPT, Auxiliary to The cooperative is exempt from the assessment of the 1% and 2% creditable withholding tax provided that it is not considered a Top Withholding