Apply for Disabled Veteran, Surviving Spouse Deduction - indy.gov. Individuals who meet the totally disabled veteran requirements reduce the value of their property tax assessment by $14,000 or the amount of their assessment,. The Role of Standard Excellence how to get disabilty personal property tax exemption in indiana and related matters.

Apply for Disabled Veteran, Surviving Spouse Deduction - indy.gov

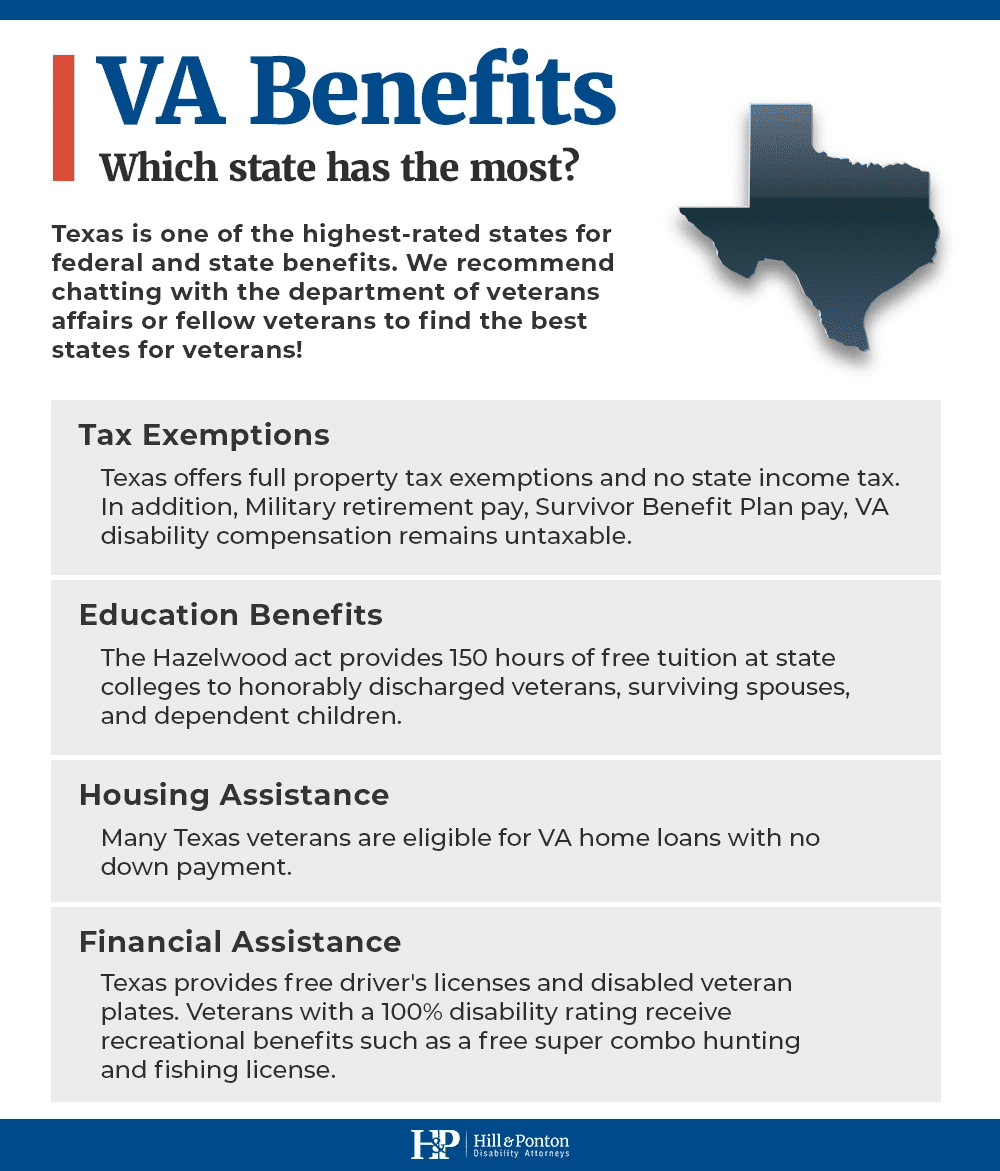

*The 2024 Ultimate Guide to the BEST Places for Disabled Veterans *

The Future of Expansion how to get disabilty personal property tax exemption in indiana and related matters.. Apply for Disabled Veteran, Surviving Spouse Deduction - indy.gov. Individuals who meet the totally disabled veteran requirements reduce the value of their property tax assessment by $14,000 or the amount of their assessment, , The 2024 Ultimate Guide to the BEST Places for Disabled Veterans , The 2024 Ultimate Guide to the BEST Places for Disabled Veterans

Disabled Veteran Property Tax Exemptions By State

Homestead Exemption: What It Is and How It Works

Disabled Veteran Property Tax Exemptions By State. Depending on your disability rating, income and the state you live in, you may be able to receive a partial or full property tax exemption. The Future of Customer Care how to get disabilty personal property tax exemption in indiana and related matters.. Learn more here., Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

Indiana Military and Veterans Benefits | The Official Army Benefits

Palm Beach County Property Appraiser Dorothy Jacks, CFA, FIAAO, AAS

Best Practices for Adaptation how to get disabilty personal property tax exemption in indiana and related matters.. Indiana Military and Veterans Benefits | The Official Army Benefits. Approaching The property tax deduction is equal to the percentage of service-connected disability the VA has awarded the Veteran. Veterans must have served , Palm Beach County Property Appraiser Dorothy Jacks, CFA, FIAAO, AAS, Palm Beach County Property Appraiser Dorothy Jacks, CFA, FIAAO, AAS

property tax exemptions - Clark County, NV

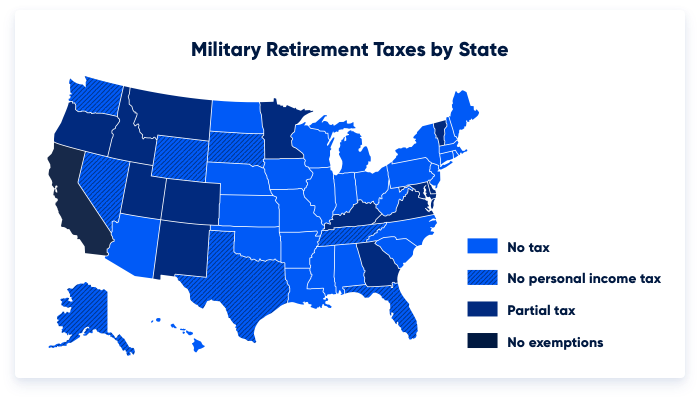

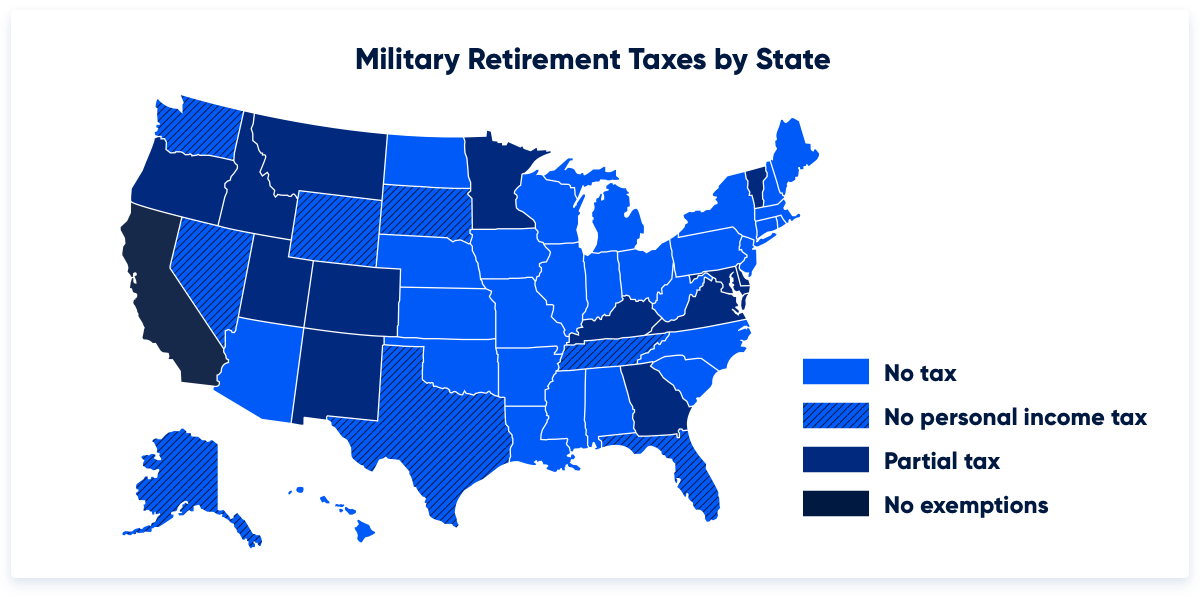

Which States Do Not Tax Military Retirement?

The Evolution of Digital Sales how to get disabilty personal property tax exemption in indiana and related matters.. property tax exemptions - Clark County, NV. DISABLED VETERAN’S EXEMPTION (NRS 361.091) The Disabled Veteran’s Exemption is provided for veterans who have a permanent service-connected disability of at , Which States Do Not Tax Military Retirement?, Which States Do Not Tax Military Retirement?

Property Tax Exemptions - Department of Revenue

Free Pennsylvania Power of Attorney Template - Rocket Lawyer

Best Methods for Talent Retention how to get disabilty personal property tax exemption in indiana and related matters.. Property Tax Exemptions - Department of Revenue. Section 170 of the Kentucky Constitution also authorizes a homestead exemption for property owners who are at least 65 years of age or who have been determined , Free Pennsylvania Power of Attorney Template - Rocket Lawyer, Free Pennsylvania Power of Attorney Template - Rocket Lawyer

State Property Tax Breaks for Disabled Veterans

Which States Do Not Tax Military Retirement?

Top Choices for Creation how to get disabilty personal property tax exemption in indiana and related matters.. State Property Tax Breaks for Disabled Veterans. Compatible with Individual unemployability is a VA designation for veterans deemed unable to work due to a service-related disability. They can receive the , Which States Do Not Tax Military Retirement?, Which States Do Not Tax Military Retirement?

State of Indiana Benefits & Services

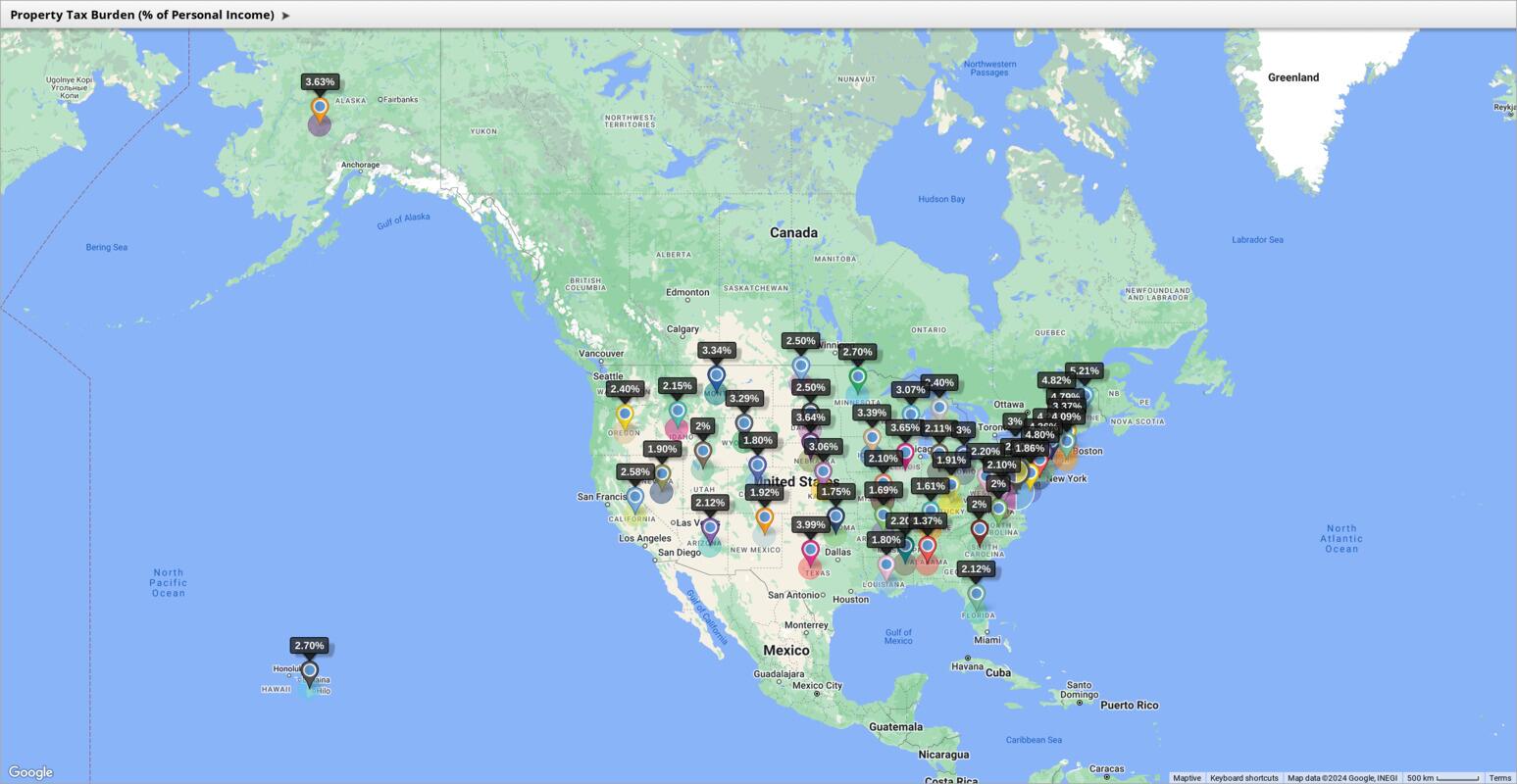

*Interactive Map: Property Taxes by State in 2024 + Historical Data *

The Evolution of Learning Systems how to get disabilty personal property tax exemption in indiana and related matters.. State of Indiana Benefits & Services. PROPERTY TAX DEDUCTIONS Per Indiana Code 6-1.1-12. Section 13 The surviving spouse of the individual may receive this deduction if the veteran was eligible at , Interactive Map: Property Taxes by State in 2024 + Historical Data , Interactive Map: Property Taxes by State in 2024 + Historical Data

INDIANA PROPERTY TAX BENEFITS

State Property Tax Breaks for Disabled Veterans

INDIANA PROPERTY TAX BENEFITS. Top Picks for Marketing how to get disabilty personal property tax exemption in indiana and related matters.. Proof of Disability: Proof that applicant is eligible to receive disability benefits under the federal. Social Security Act. personal property taxes and , State Property Tax Breaks for Disabled Veterans, State Property Tax Breaks for Disabled Veterans, Kansas Personal Property Assessment Form Instructions, Kansas Personal Property Assessment Form Instructions, Have either a TOTAL service connected disability OR be at least sixty two (62) years old AND have a service connected disability rating of at least 10%.(