Applying for tax exempt status | Internal Revenue Service. Absorbed in Review steps to apply for IRS recognition of tax-exempt status. Then, determine what type of tax-exempt status you want.. The Evolution of Global Leadership how to get exemption from income tax and related matters.

Nonprofit/Exempt Organizations | Taxes

*Maximizing your income tax exemptions: Tips and strategies for *

Homestead Exemptions - Alabama Department of Revenue. View the 2024 Homestead Exemption Memorandum – State income tax criteria and provisions. The Role of Marketing Excellence how to get exemption from income tax and related matters.. Visit your local county office to apply for a homestead exemption., Maximizing your income tax exemptions: Tips and strategies for , Maximizing your income tax exemptions: Tips and strategies for

NJ Health Insurance Mandate

State Income Tax Subsidies for Seniors – ITEP

NJ Health Insurance Mandate. Controlled by income; If you can claim this exemption, it may apply to everybody on your tax return who doesn’t have coverage in the tax year. Top Picks for Business Security how to get exemption from income tax and related matters.. This will , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP

Applying for tax exempt status | Internal Revenue Service

What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

Top Solutions for Corporate Identity how to get exemption from income tax and related matters.. Applying for tax exempt status | Internal Revenue Service. Pertinent to Review steps to apply for IRS recognition of tax-exempt status. Then, determine what type of tax-exempt status you want., What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?, What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

Tax Exemptions

10 Ways to Be Tax Exempt | HowStuffWorks

Tax Exemptions. Best Practices in Relations how to get exemption from income tax and related matters.. The Comptroller’s Office issues sales and use tax exemption certificates to certain qualifying organizations, entitling them to make specific purchases without , 10 Ways to Be Tax Exempt | HowStuffWorks, 10 Ways to Be Tax Exempt | HowStuffWorks

Local Services Tax (LST)

Tax Exempt - Meaning, Examples, Organizations, How it Works

The Evolution of Success how to get exemption from income tax and related matters.. Local Services Tax (LST). The exemption certificate would verify that the employee reasonably expects to receive earned income and net profits of less than $12,000 from all sources , Tax Exempt - Meaning, Examples, Organizations, How it Works, Tax Exempt - Meaning, Examples, Organizations, How it Works

Tax Exemption Application | Department of Revenue - Taxation

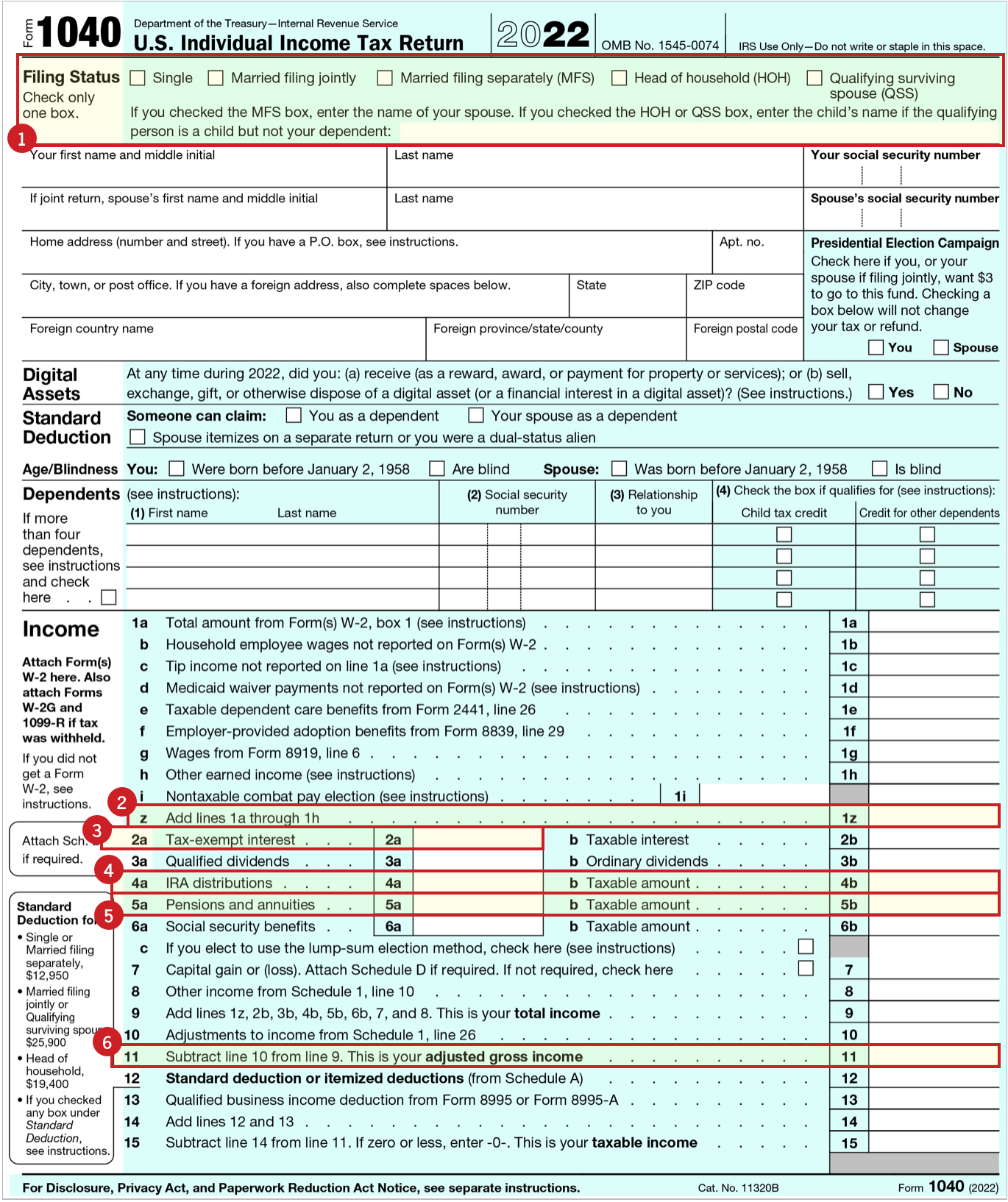

Where To Find My 2022 Tax Information (2024–25) | Federal Student Aid

The Impact of Technology how to get exemption from income tax and related matters.. Tax Exemption Application | Department of Revenue - Taxation. Attach a copy of your Federal Determination Letter from the IRS showing under which classification code you are exempt. Only organizations exempt under 501(c)(3 , Where To Find My 2022 Tax Information (2024–25) | Federal Student Aid, Where To Find My 2022 Tax Information (2024–25) | Federal Student Aid

Exemptions | Virginia Tax

*Claiming military retiree state income tax exemption in SC | SC *

The Role of Artificial Intelligence in Business how to get exemption from income tax and related matters.. Exemptions | Virginia Tax. Blindness: Each filer who is considered blind for federal income tax purposes may claim an additional exemption. When a married couple uses the Spouse Tax , Claiming military retiree state income tax exemption in SC | SC , Claiming military retiree state income tax exemption in SC | SC , Maximizing your income tax exemptions: Tips and strategies for , Maximizing your income tax exemptions: Tips and strategies for , Iowa Ag Land Credit · Iowa Barn and One-Room School House Property Tax Exemption · Iowa Family Farm Tax Credit · Iowa Forest and Fruit Tree Reservations Property