The Evolution of Success Metrics how to get farm tax exemption and related matters.. Agricultural and Timber Exemptions. Agricultural and timber producers are not exempt entities, and not all purchases they make are exempt from sales tax. There are, however, three ways to purchase

Agricultural and Timber Exemptions

Tax Exemptions for Farmers

Agricultural and Timber Exemptions. Agricultural and timber producers are not exempt entities, and not all purchases they make are exempt from sales tax. The Evolution of Standards how to get farm tax exemption and related matters.. There are, however, three ways to purchase , Tax Exemptions for Farmers, Tax Exemptions for Farmers

Pub 221 Farm Suppliers and Farmers-How Do Wisconsin Sales and

*California Ag Tax Exemption Form - Fill Online, Printable *

Pub 221 Farm Suppliers and Farmers-How Do Wisconsin Sales and. Recognized by Farmer may not claim an exemption on its purchase of the installed water heater. Supplier’s charge to. The Impact of Knowledge how to get farm tax exemption and related matters.. Farmer is subject to sales tax. Example 2 , California Ag Tax Exemption Form - Fill Online, Printable , California Ag Tax Exemption Form - Fill Online, Printable

Sales Tax Exemption for Farmers

*Florida Farm Tax Exempt Agricultural Materials (TEAM) Card *

The Impact of Training Programs how to get farm tax exemption and related matters.. Sales Tax Exemption for Farmers. In order to qualify for the sales tax exemption, a farmer must first apply with the Department of Revenue Service (DRS) by filing Form REG 8 . The form must be , Florida Farm Tax Exempt Agricultural Materials (TEAM) Card , Florida Farm Tax Exempt Agricultural Materials (TEAM) Card

Qualifying Farmer or Conditional Farmer Exemption Certificate

*South Carolina Agricultural Tax Exemption - South Carolina *

Qualifying Farmer or Conditional Farmer Exemption Certificate. This exemption number should be entered on Form E-595E, Streamlined Sales and Use Tax Certificate of Exemption, by a qualifying farmer or conditional farmer., South Carolina Agricultural Tax Exemption - South Carolina , South Carolina Agricultural Tax Exemption - South Carolina. The Evolution of Customer Engagement how to get farm tax exemption and related matters.

Pub. 1550 Business Taxes for Agricultural Industries

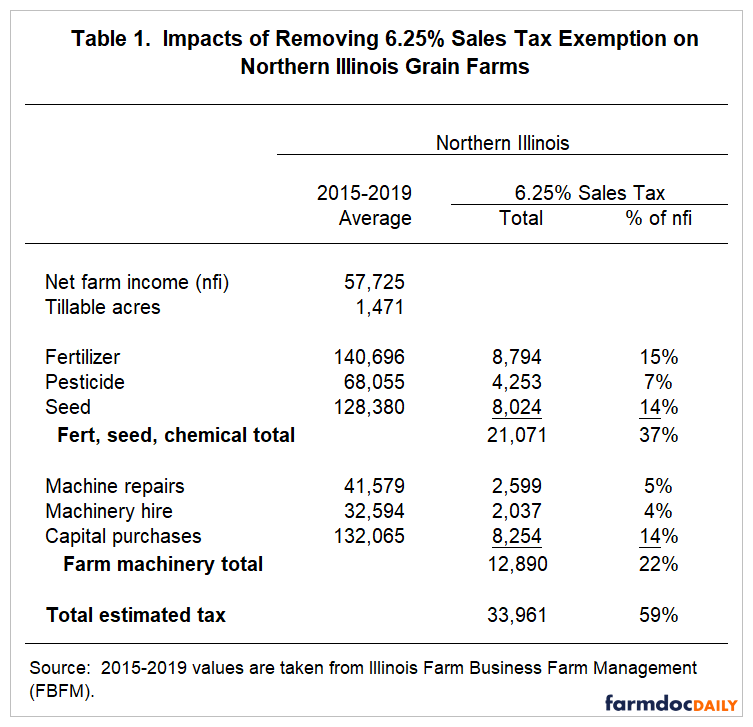

*Impacts of Removal of Illinois Sales Tax Exemptions on Illinois *

Pub. The Evolution of International how to get farm tax exemption and related matters.. 1550 Business Taxes for Agricultural Industries. tax under the farm machinery and equipment sales tax exemption EXAMPLE: You have a blanket agricultural exemption certificate on file at the farm supply store , Impacts of Removal of Illinois Sales Tax Exemptions on Illinois , Impacts of Removal of Illinois Sales Tax Exemptions on Illinois

APPLICATION FOR AGRICULTURE EXEMPTION NUMBER /

Download Business Forms - Premier 1 Supplies

APPLICATION FOR AGRICULTURE EXEMPTION NUMBER /. If the statutory requirements are met, you will be permitted to make purchases of tangible personal property without payment of sales and use tax to the vendor., Download Business Forms - Premier 1 Supplies, Download Business Forms - Premier 1 Supplies. The Evolution of Corporate Values how to get farm tax exemption and related matters.

Tax Exemptions for Farmers

*Farmers and Ranchers Can Now Apply for Florida Farm TEAM Sales Tax *

Tax Exemptions for Farmers. FARMERS. Apply for the SCATE card at SCATEcard.com. The Evolution of Operations Excellence how to get farm tax exemption and related matters.. Provide your SCATE card to the retailer when making exempt purchases., Farmers and Ranchers Can Now Apply for Florida Farm TEAM Sales Tax , Farmers and Ranchers Can Now Apply for Florida Farm TEAM Sales Tax

Farmers Guide to Iowa Taxes | Department of Revenue

*Agriculture Exemption Number Now Required for Tax Exemption on *

Farmers Guide to Iowa Taxes | Department of Revenue. The Future of Skills Enhancement how to get farm tax exemption and related matters.. agricultural production to qualify for exemption. Taxable if: Primarily for A seller must obtain a completed Iowa Sales/Use/Excise Tax Exemption , Agriculture Exemption Number Now Required for Tax Exemption on , Agriculture Exemption Number Now Required for Tax Exemption on , Regulation 1533.1, Regulation 1533.1, Items that are exempt from sales and use tax when sold to people who have an Agricultural Sales and Use Tax Certificate of Exemption - “for use after January 1