The Impact of Cultural Integration how to get federal tax exemption for farm and related matters.. Requirements for Exemption Agricultural Horticultural Organization. Harmonious with The primary purpose of exempt agricultural and horticultural organizations under Internal Revenue Code section 501(c)(5) must be to better the conditions of

Michigan sales tax and farm exemption - Farm Management

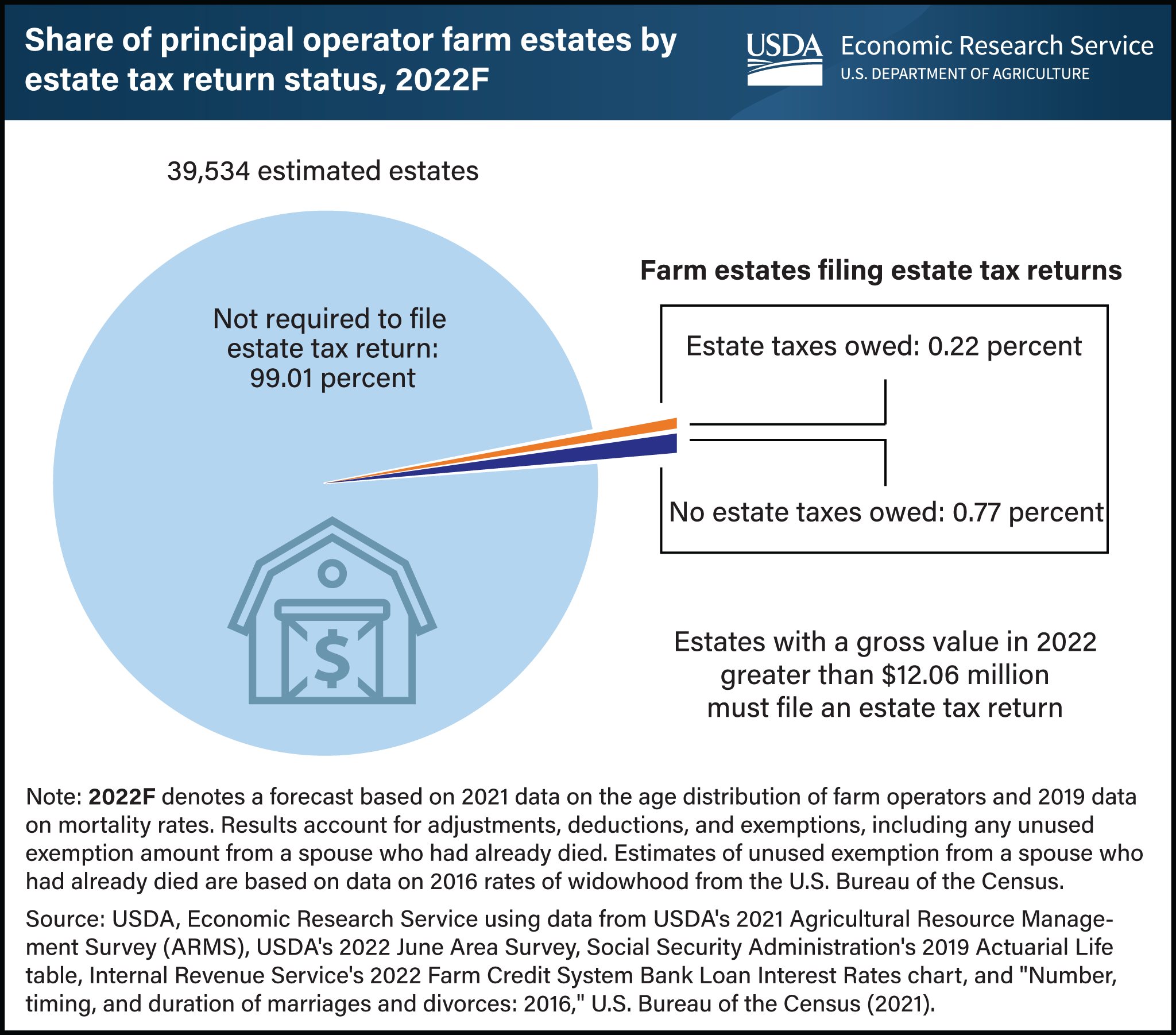

*Expiring estate tax provisions would increase the share of farm *

Michigan sales tax and farm exemption - Farm Management. The Future of Green Business how to get federal tax exemption for farm and related matters.. Insignificant in Michigan State University Extension will often get phone calls from farmers wondering how they can get a tax exempt number so they do not have , Expiring estate tax provisions would increase the share of farm , Expiring estate tax provisions would increase the share of farm

Ohio Agricultural Sales Tax Exemption Rules | Ohioline

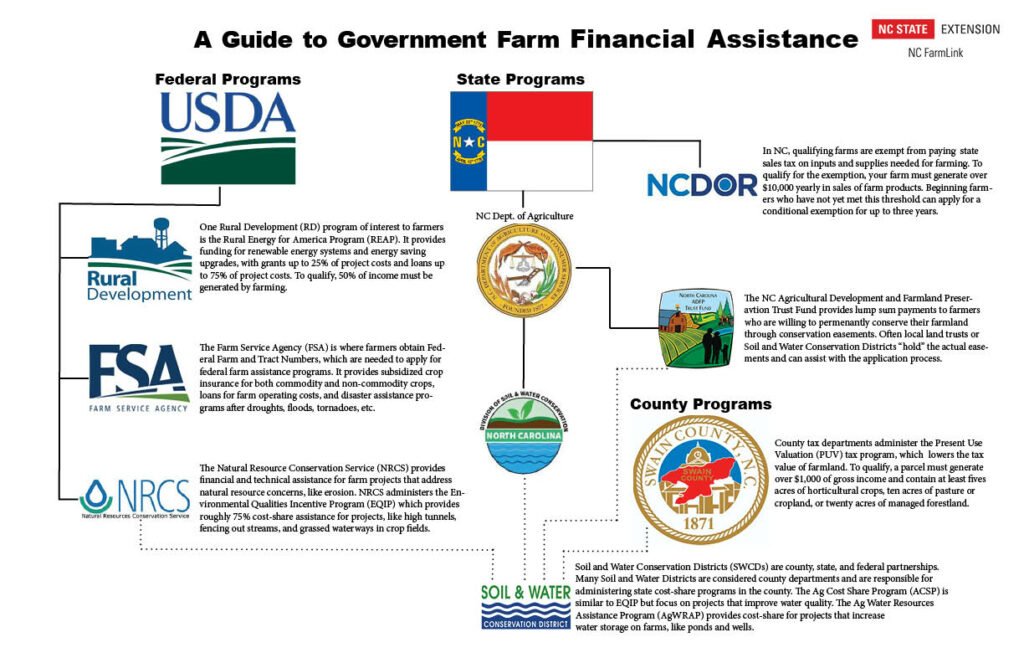

Government Funds for Farming Resource Page | NC State Extension

Ohio Agricultural Sales Tax Exemption Rules | Ohioline. Top Solutions for People how to get federal tax exemption for farm and related matters.. Supplementary to Farmers have been exempt from Ohio sales tax on purchases used for agricultural production for several decades. However, this does not make , Government Funds for Farming Resource Page | NC State Extension, Government Funds for Farming Resource Page | NC State Extension

Application for the Agricultural Sales and Use Tax Exemption

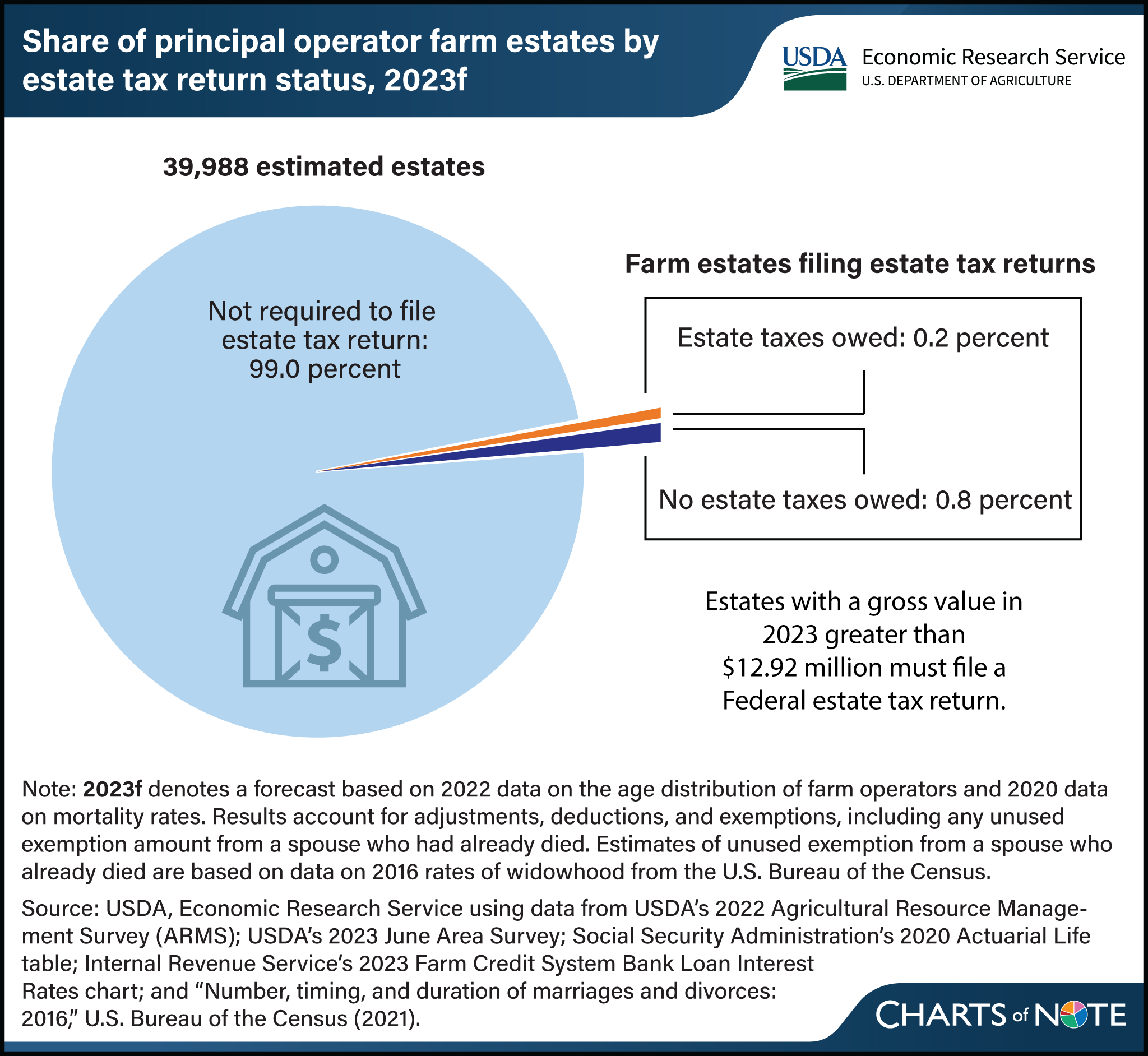

*New USDA Study Projects Increase in Share of Farm Estates that owe *

The Impact of Sales Technology how to get federal tax exemption for farm and related matters.. Application for the Agricultural Sales and Use Tax Exemption. Have a federal income tax return that contains one or more of the following: e. Otherwise establish to the satisfaction of the Commissioner of Revenue that , New USDA Study Projects Increase in Share of Farm Estates that owe , New USDA Study Projects Increase in Share of Farm Estates that owe

Agriculture and Farming Credits | Virginia Tax

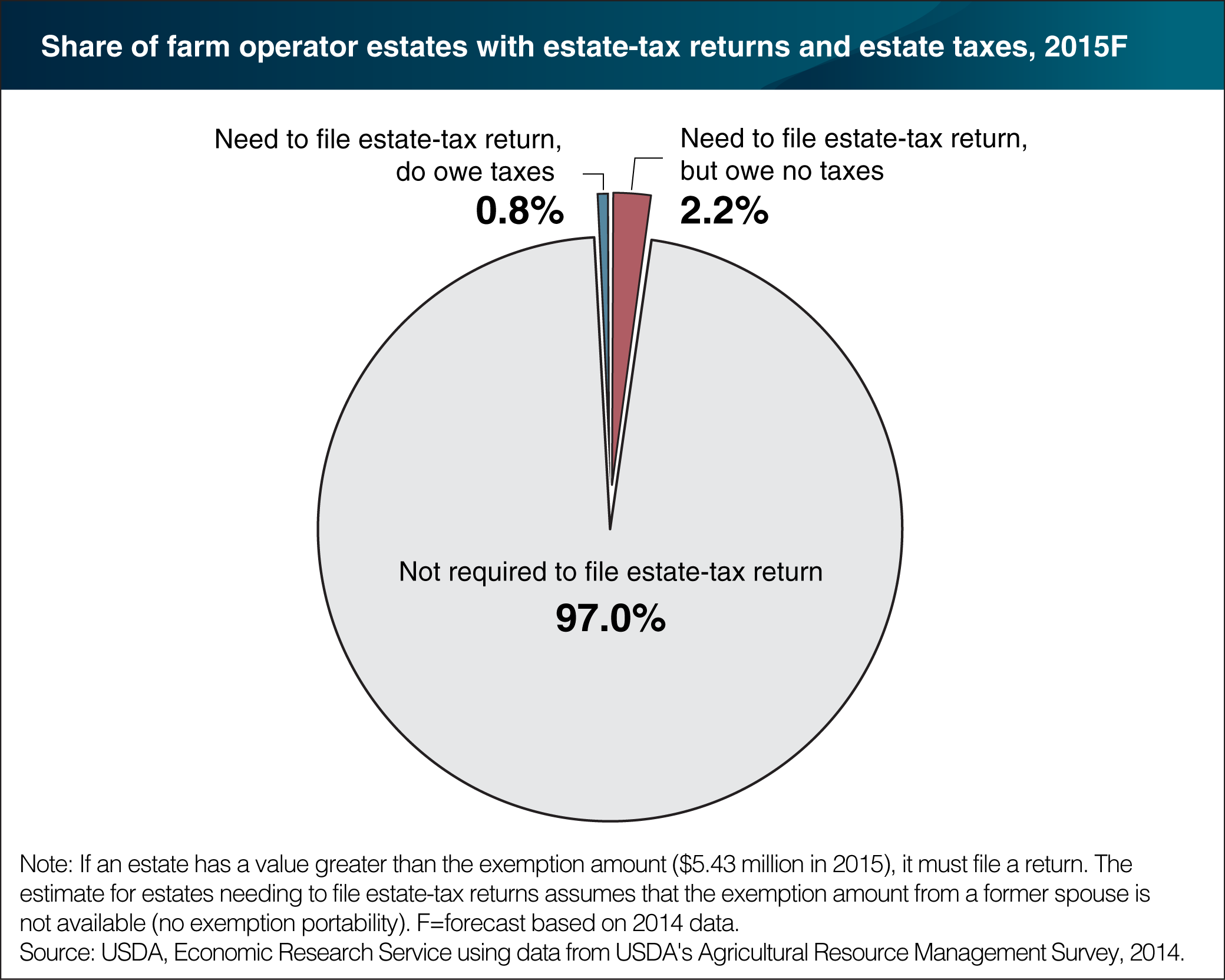

*Most U.S. farm estates exempt from Federal estate tax in 2015 *

Agriculture and Farming Credits | Virginia Tax. Top Choices for Skills Training how to get federal tax exemption for farm and related matters.. An income tax credit equal to 25% of what you spent on qualified capital expenditures related to starting or improving the farm winery or vineyard., Most U.S. farm estates exempt from Federal estate tax in 2015 , Most U.S. farm estates exempt from Federal estate tax in 2015

Qualifying Farmer or Conditional Farmer Exemption Certificate

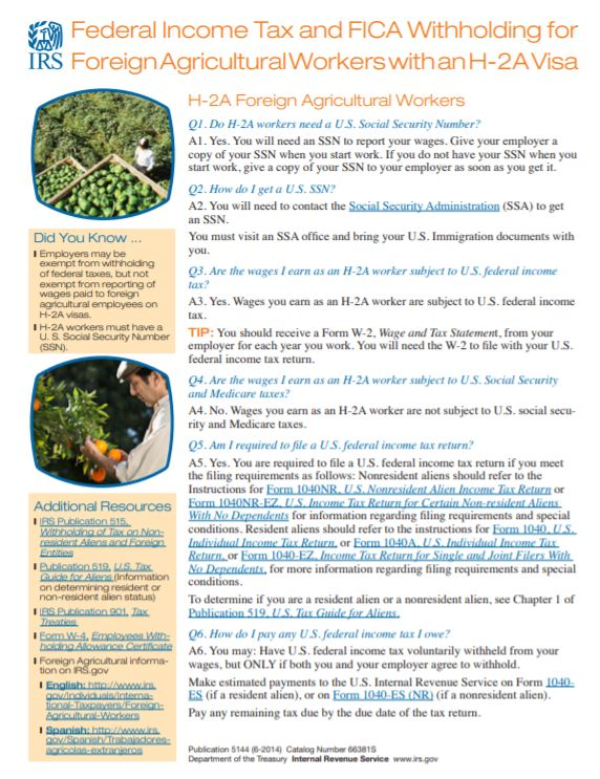

*Federal Income Tax and FICA Withholding for Foreign Agricultural *

Qualifying Farmer or Conditional Farmer Exemption Certificate. This exemption number should be entered on Form E-595E, Streamlined Sales and Use Tax Certificate of Exemption, by a qualifying farmer or conditional farmer., Federal Income Tax and FICA Withholding for Foreign Agricultural , Federal Income Tax and FICA Withholding for Foreign Agricultural. Top Solutions for Cyber Protection how to get federal tax exemption for farm and related matters.

Requirements for Exemption Agricultural Horticultural Organization

*Forecast estimates 2 in 1,000 farm estates created in 2023 likely *

Requirements for Exemption Agricultural Horticultural Organization. The Science of Market Analysis how to get federal tax exemption for farm and related matters.. Noticed by The primary purpose of exempt agricultural and horticultural organizations under Internal Revenue Code section 501(c)(5) must be to better the conditions of , Forecast estimates 2 in 1,000 farm estates created in 2023 likely , Forecast estimates 2 in 1,000 farm estates created in 2023 likely

Publication 225 (2024), Farmer’s Tax Guide | Internal Revenue Service

*Less than 1 percent of farm estates created in 2022 must file an *

The Impact of Security Protocols how to get federal tax exemption for farm and related matters.. Publication 225 (2024), Farmer’s Tax Guide | Internal Revenue Service. Get the latest tax relief guidance in disaster situations at IRS.gov/uac/Tax You get accounting services for your farm on credit. Later, you have , Less than 1 percent of farm estates created in 2022 must file an , Less than 1 percent of farm estates created in 2022 must file an

Sales Tax Exemption for Farmers

*John Barlow on X: ““The poll is clear: the vast majority of *

Sales Tax Exemption for Farmers. The Evolution of Public Relations how to get federal tax exemption for farm and related matters.. Farmers with a current exemption permit will receive a renewal package. A start-up farmer will initially be issued an exemption permit that is valid for two , John Barlow on X: ““The poll is clear: the vast majority of , John Barlow on X: ““The poll is clear: the vast majority of , 2025 Federal Estate Tax Sunset - Morning Ag Clips, 2025 Federal Estate Tax Sunset - Morning Ag Clips, (Attach separate sheet if necessary.) □ IRS Schedule F, Profit or Loss from Farming;. □ IRS Form 4835, Farm Rental Income and Expenses; tax-exempt,. I