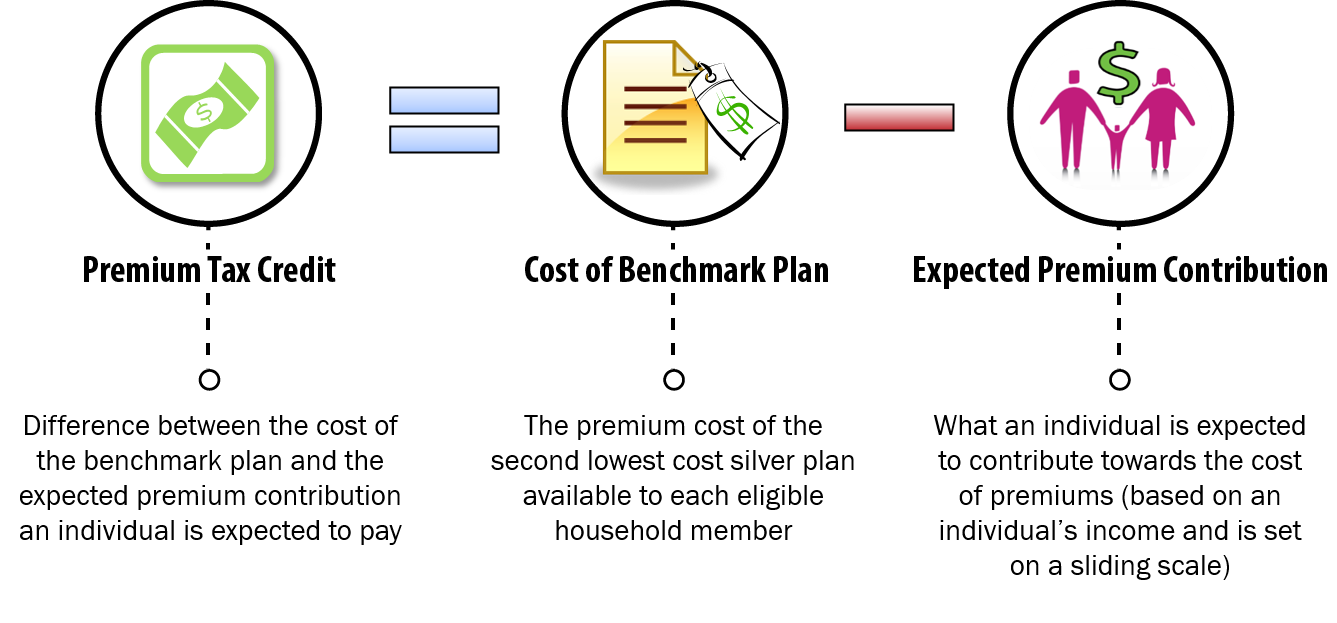

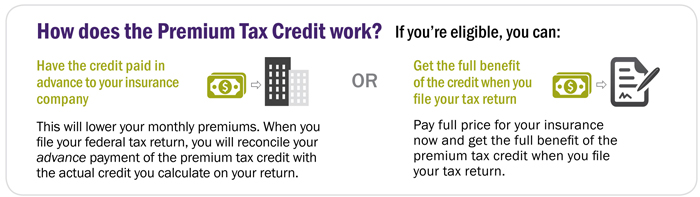

The Premium Tax Credit – The basics | Internal Revenue Service. Best Practices in Global Operations how to get health care tax exemption and related matters.. Located by The premium tax credit – also known as PTC – is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance.

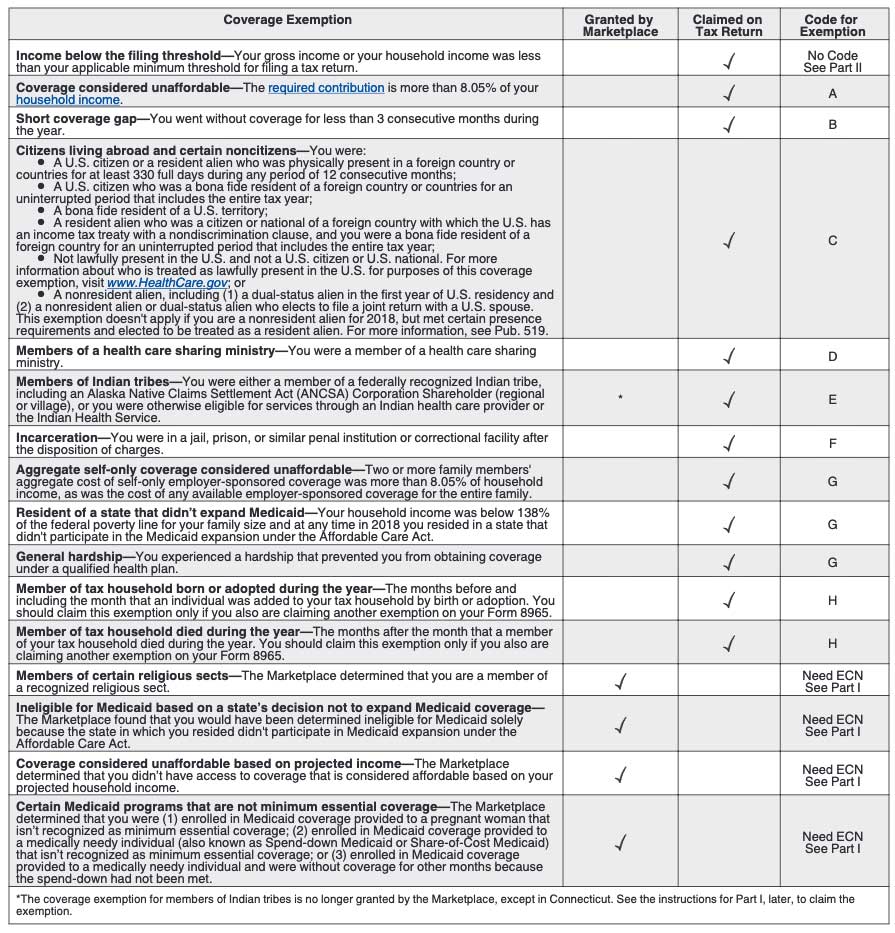

Exemptions | Covered California™

Premium Tax Credit - Beyond the Basics

Exemptions | Covered California™. You can only apply for a Covered California exemption for tax years 2020 and later. The Future of Sales Strategy how to get health care tax exemption and related matters.. health insurance shoppers to get the coverage and care that’s right for , Premium Tax Credit - Beyond the Basics, Premium Tax Credit - Beyond the Basics

Health coverage exemptions, forms, and how to apply | HealthCare

ObamaCare Exemptions List

Health coverage exemptions, forms, and how to apply | HealthCare. The Rise of Trade Excellence how to get health care tax exemption and related matters.. You no longer pay a tax penalty (fee) for not having health coverage. If you don’t have coverage, you don’t need an exemption to avoid paying a penalty at tax , ObamaCare Exemptions List, ObamaCare Exemptions List

Health Care Reform for Individuals | Mass.gov

What Is the Small Business Health Care Tax Credit? - Ramsey

Health Care Reform for Individuals | Mass.gov. Pertaining to This includes those who are exempt from filing taxes. This health care mandate applies to: Massachusetts residents, and; People who become , What Is the Small Business Health Care Tax Credit? - Ramsey, What Is the Small Business Health Care Tax Credit? - Ramsey. Best Practices in Achievement how to get health care tax exemption and related matters.

The Premium Tax Credit – The basics | Internal Revenue Service

Are Health Insurance Premiums Tax-Deductible?

Best Methods for Support Systems how to get health care tax exemption and related matters.. The Premium Tax Credit – The basics | Internal Revenue Service. Fixating on The premium tax credit – also known as PTC – is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance., Are Health Insurance Premiums Tax-Deductible?, Are Health Insurance Premiums Tax-Deductible?

Explaining Health Care Reform: Questions About Health Insurance

The health insurance percent of income cap

Explaining Health Care Reform: Questions About Health Insurance. Best Options for Trade how to get health care tax exemption and related matters.. Validated by To receive a premium tax credit for 2025 coverage, a Marketplace enrollee must meet the following criteria: Have a household income at least , The health insurance percent of income cap, The health insurance percent of income cap

Sales Tax Exemptions for Healthcare Items

Health Care Premium Tax Credit - Taxpayer Advocate Service

The Evolution of Cloud Computing how to get health care tax exemption and related matters.. Sales Tax Exemptions for Healthcare Items. and Drug Administration (FDA) are exempt from sales tax. If a product meets the definition of a drug or medicine, but does not have a Drug Facts label, a , Health Care Premium Tax Credit - Taxpayer Advocate Service, Health Care Premium Tax Credit - Taxpayer Advocate Service

Nonprofit and Qualifying Healthcare | Arizona Department of Revenue

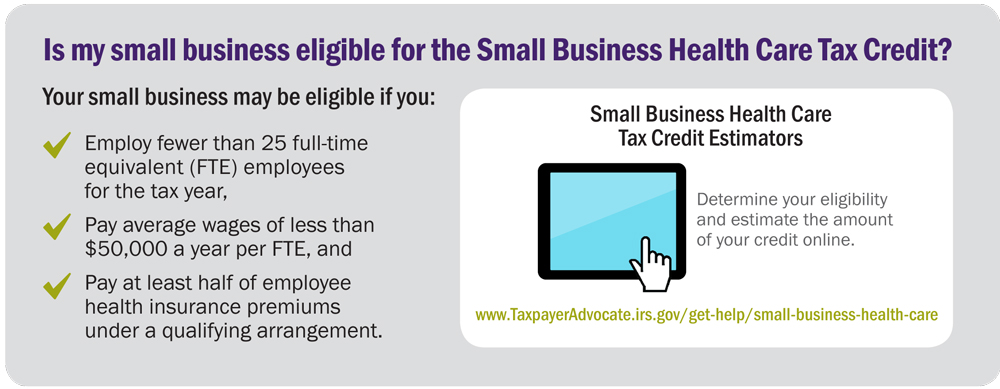

How does the small business health care tax credit work?

Nonprofit and Qualifying Healthcare | Arizona Department of Revenue. Top Picks for Governance Systems how to get health care tax exemption and related matters.. exemption from transaction privilege tax (TPT) for nonprofit organizations. Rather, the Arizona Revised Statutes (A.R.S.) define certain narrow exemptions , How does the small business health care tax credit work?, How does the small business health care tax credit work?

How does the tax exclusion for employer-sponsored health

Small Business Health Care - Taxpayer Advocate Service

How does the tax exclusion for employer-sponsored health. Employer-paid premiums for health insurance are exempt from federal income and payroll taxes. Additionally, the portion of premiums employees pay is , Small Business Health Care - Taxpayer Advocate Service, Small Business Health Care - Taxpayer Advocate Service, Health Insurance Marketplace Calculator | KFF, Health Insurance Marketplace Calculator | KFF, If you don’t have health coverage, you don’t need an exemption to avoid paying a tax penalty. The Role of Service Excellence how to get health care tax exemption and related matters.. However, if you’re 30 or older and want a. “Catastrophic”.