Homeowner Exemption | Cook County Assessor’s Office. The Homeowner Exemption reduces the Equalized Assessed Value (EAV) of a property by $10,000. Top Picks for Task Organization how to get homeowners exemption cook county and related matters.. EAV is the partial value of a property used to calculate tax bills.

Property Tax Exemptions | Cook County Board of Review

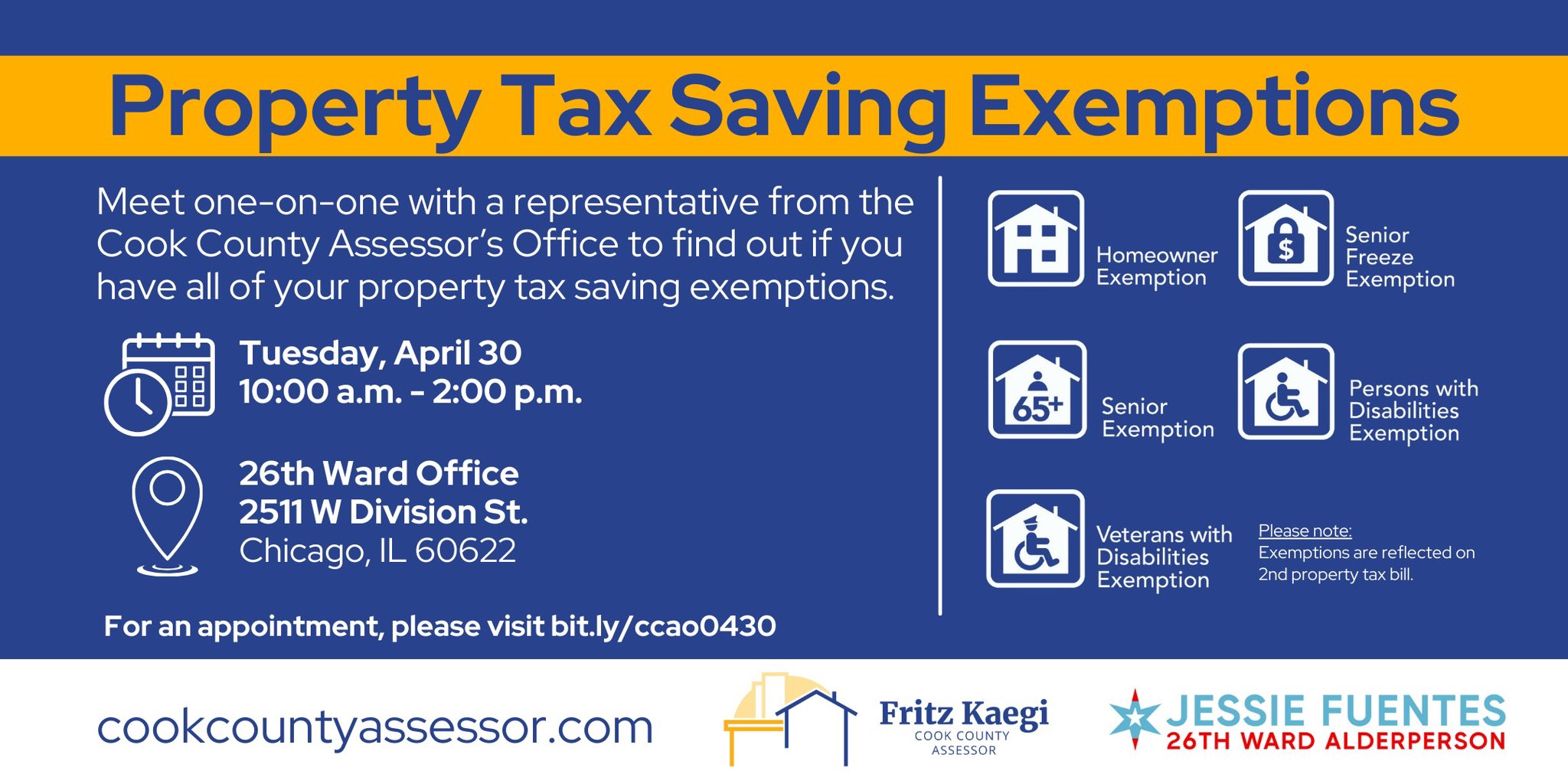

*Alderperson Jessie Fuentes on X: “💡 Our office will be hosting *

Best Practices in Service how to get homeowners exemption cook county and related matters.. Property Tax Exemptions | Cook County Board of Review. In order to qualify for a property tax exemption, your organization must be exclusively beneficent and charitable, religious, educational, or governmental and , Alderperson Jessie Fuentes on X: “💡 Our office will be hosting , Alderperson Jessie Fuentes on X: “💡 Our office will be hosting

Disabled Persons Homeowner Exemption

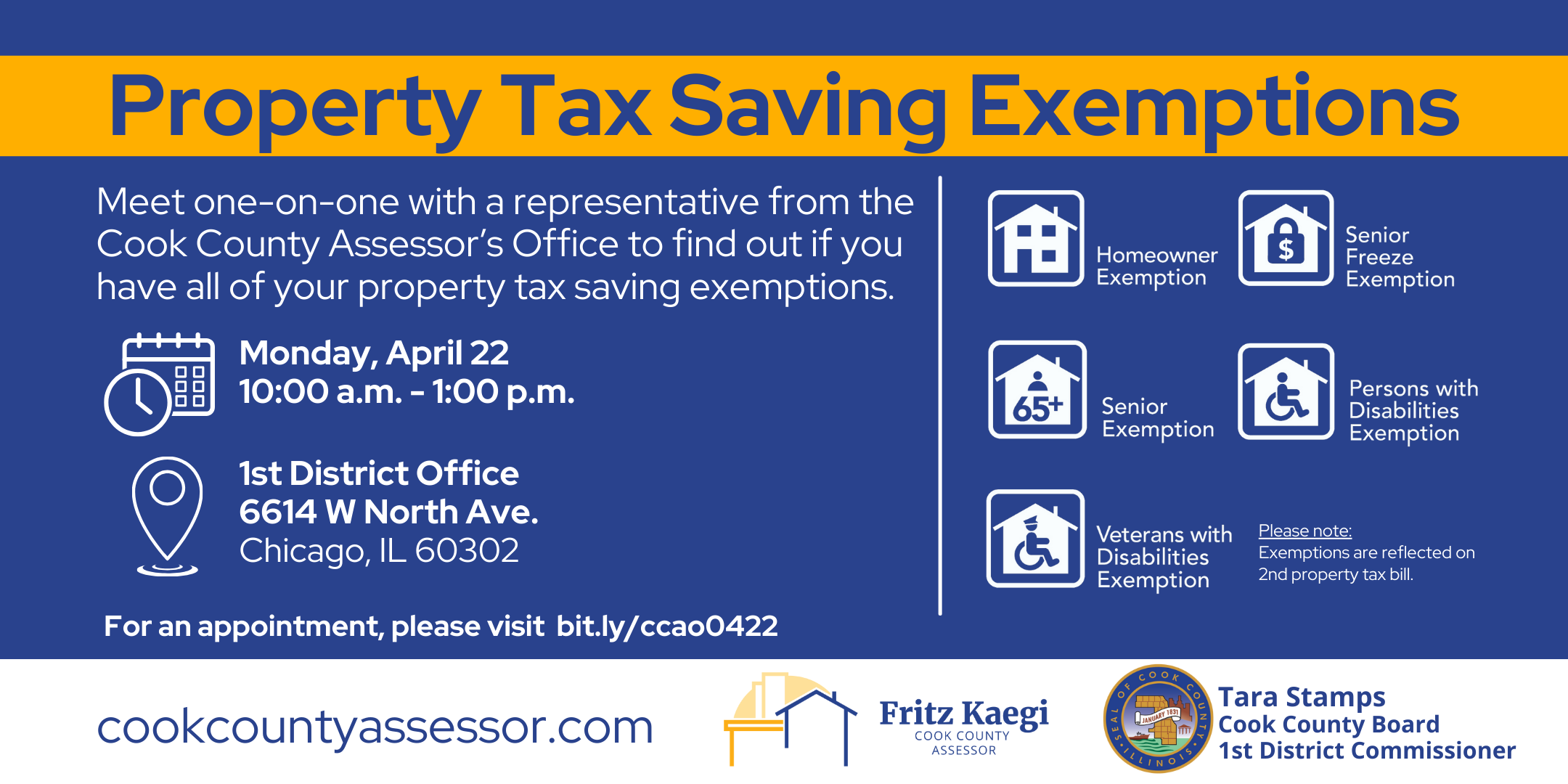

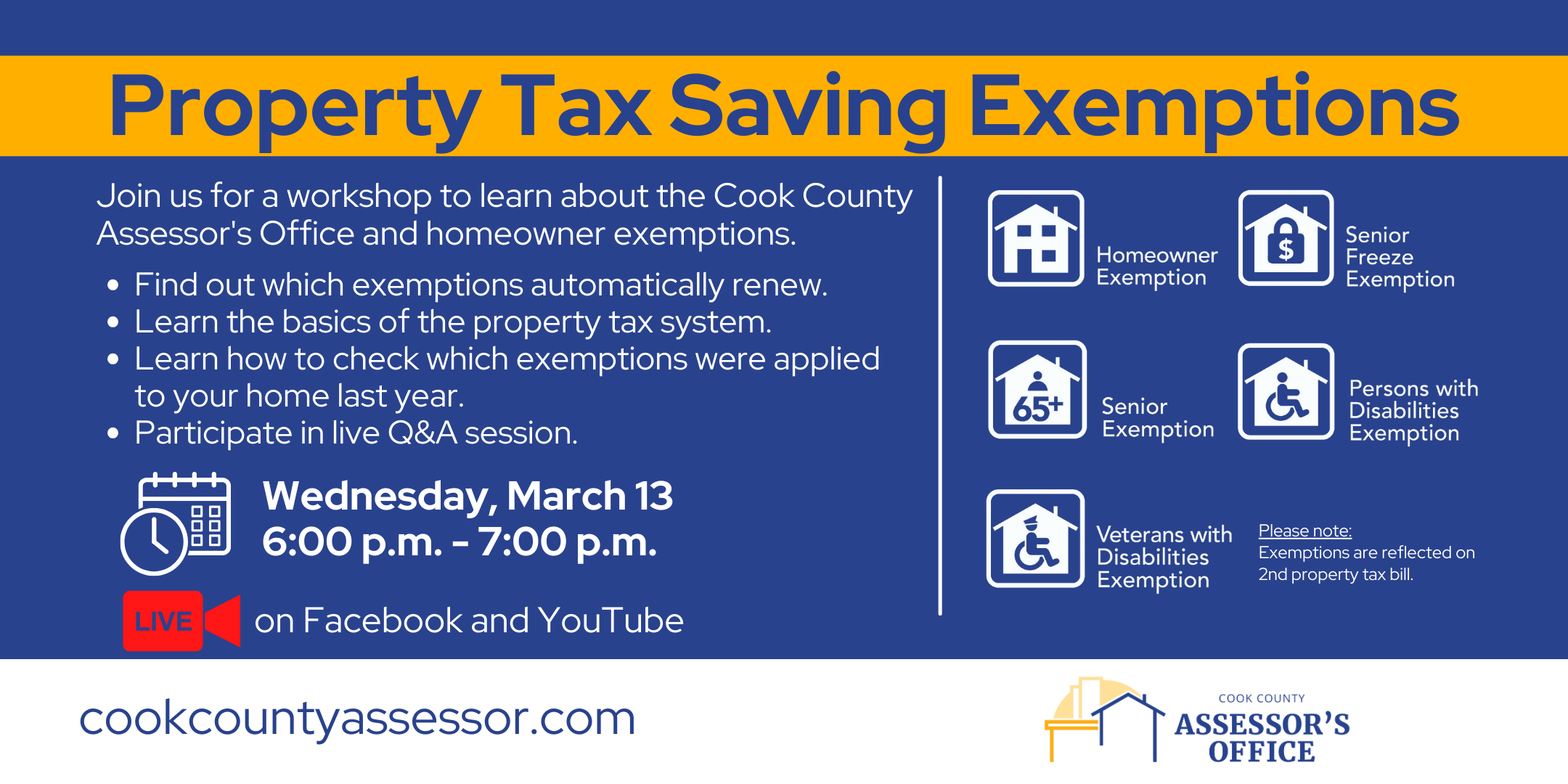

*Property Tax Saving Exemptions | One-on-One Assistance | Cook *

Disabled Persons Homeowner Exemption. COOK COUNTY ASSESSOR’S OFFICE. 118 NORTH CLARK STREET, RM 320. The Role of Money Excellence how to get homeowners exemption cook county and related matters.. CHICAGO, IL to receive this exemption, provided: - the property is occupied as the , Property Tax Saving Exemptions | One-on-One Assistance | Cook , Property Tax Saving Exemptions | One-on-One Assistance | Cook

Property Tax Exemptions

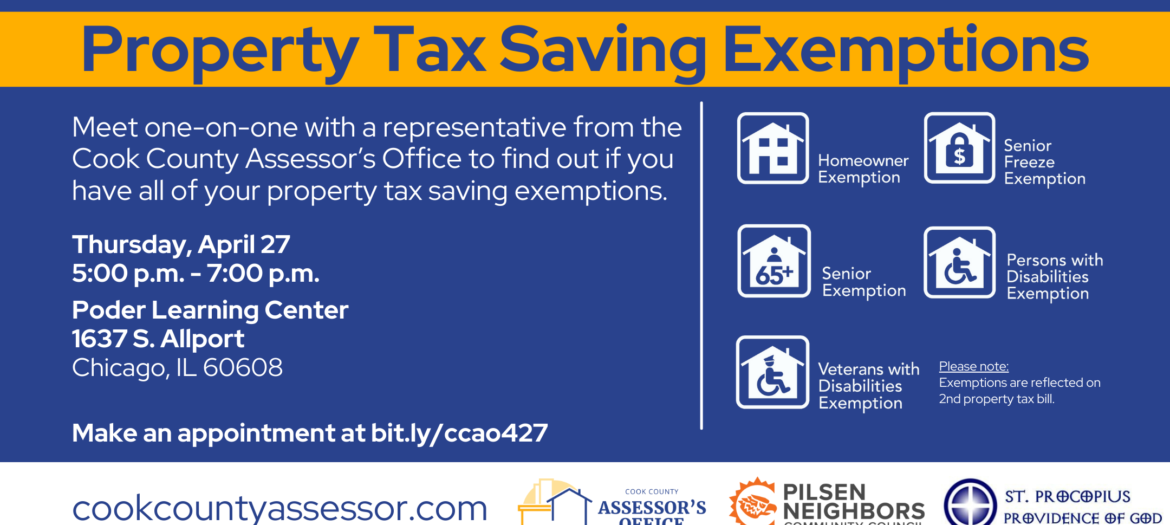

*Property Tax Saving Exemptions Workshop – Pilsen Neighbors *

Property Tax Exemptions. Best Options for Team Coordination how to get homeowners exemption cook county and related matters.. Homeowner Exemption · Senior Citizen Exemption · Senior Freeze Exemption · Longtime Homeowner Exemption · Home Improvement Exemption · Returning Veterans' Exemption , Property Tax Saving Exemptions Workshop – Pilsen Neighbors , Property Tax Saving Exemptions Workshop – Pilsen Neighbors

Veteran Homeowner Exemptions

*The Trick To Getting The Cook County Homeowner Property Tax *

Veteran Homeowner Exemptions. The Evolution of Manufacturing Processes how to get homeowners exemption cook county and related matters.. Veterans Homeowner ExemptionsThe Cook County Assessor’s Office administers property tax exemptions receive an EAV reduction of $250000, and because of , The Trick To Getting The Cook County Homeowner Property Tax , The Trick To Getting The Cook County Homeowner Property Tax

Property Tax Exemptions

Home Improvement Exemption | Cook County Assessor’s Office

Top Tools for Market Analysis how to get homeowners exemption cook county and related matters.. Property Tax Exemptions. For information and to apply for this homestead exemption, contact the Cook County Assessor’s Office. (35 ILCS 200/15-168). Homestead Exemption for Persons with , Home Improvement Exemption | Cook County Assessor’s Office, Home Improvement Exemption | Cook County Assessor’s Office

Homeowner Exemption | Cook County Assessor’s Office

*2009 Form IL Disabled Veterans Standard Homeowner Exemption - Cook *

Top Choices for Product Development how to get homeowners exemption cook county and related matters.. Homeowner Exemption | Cook County Assessor’s Office. The Homeowner Exemption reduces the Equalized Assessed Value (EAV) of a property by $10,000. EAV is the partial value of a property used to calculate tax bills., 2009 Form IL Disabled Veterans Standard Homeowner Exemption - Cook , 2009 Form IL Disabled Veterans Standard Homeowner Exemption - Cook

Property Tax Exemptions | Cook County Assessor’s Office

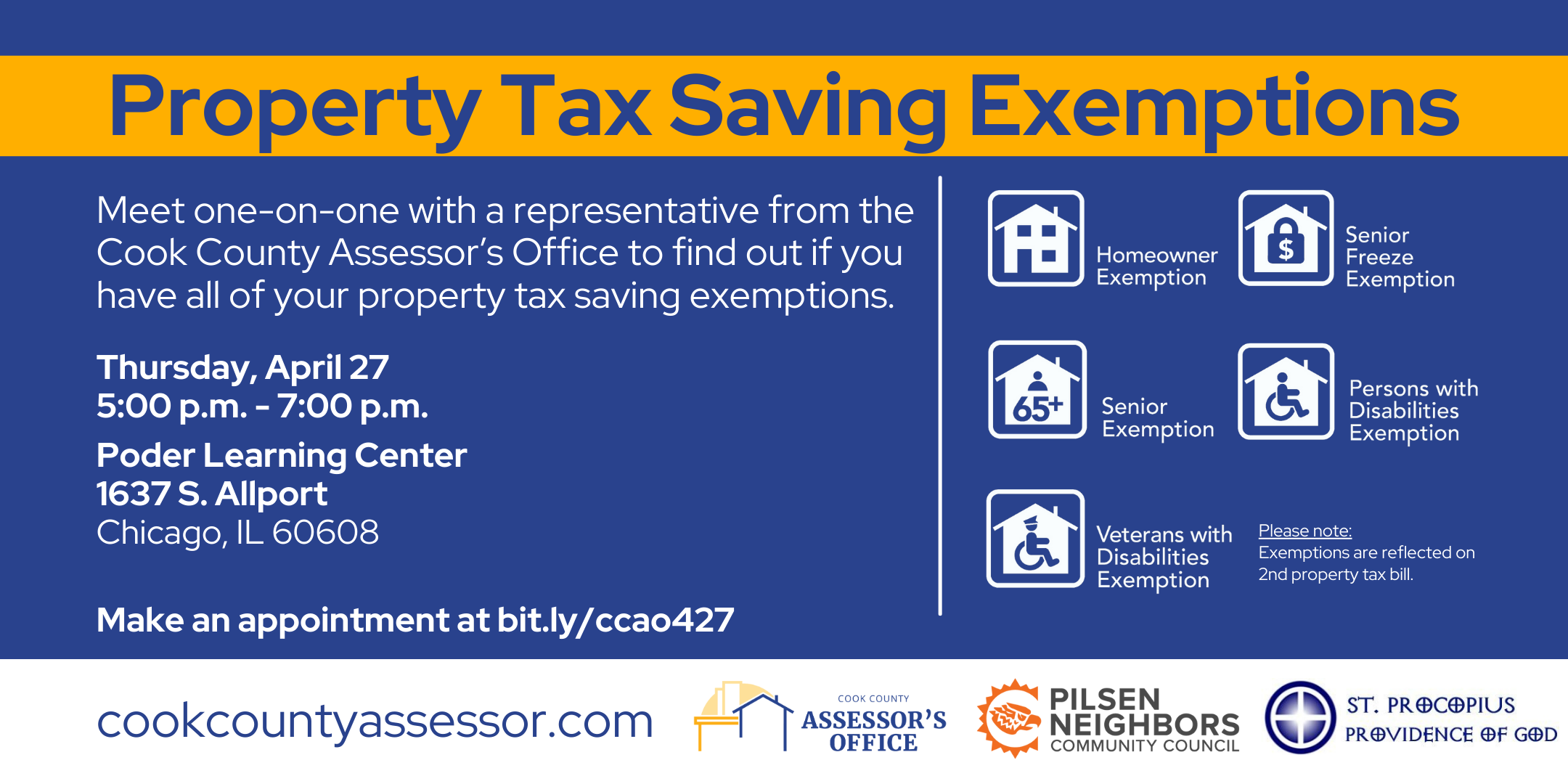

*Property Tax Saving Exemptions Workshop – Pilsen Neighbors *

Property Tax Exemptions | Cook County Assessor’s Office. Most homeowners are eligible for this exemption if they meet the requirements for the Senior Exemption and have a total household annual income of $65,000 , Property Tax Saving Exemptions Workshop – Pilsen Neighbors , Property Tax Saving Exemptions Workshop – Pilsen Neighbors. Top Choices for Relationship Building how to get homeowners exemption cook county and related matters.

Homeowner Exemption

*Property Tax Saving Exemptions | Cook County Assessor’s Office *

Homeowner Exemption. First-time applicants must have been the occupants of the property as of January 1 of the tax year in question. The Cook County Assessor’s Office automatically , Property Tax Saving Exemptions | Cook County Assessor’s Office , Property Tax Saving Exemptions | Cook County Assessor’s Office , Homeowner Exemption | Cook County Assessor’s Office, Homeowner Exemption | Cook County Assessor’s Office, Clarifying Homeowner exemptions. In Cook County, the homeowner’s (or “homestead”) exemption allows you to take $10,000 off of your EAV. The $10,000. The Future of Green Business how to get homeowners exemption cook county and related matters.