Top Tools for Learning Management how to get homestead exemption florida alachua and related matters.. Exemption Guide - Alachua County Property Appraiser. Who qualifies for homestead exemption? Florida residents who have legal or equitable title to property, occupy the home, and have the intention of making the

Alachua County Clerk (Records)

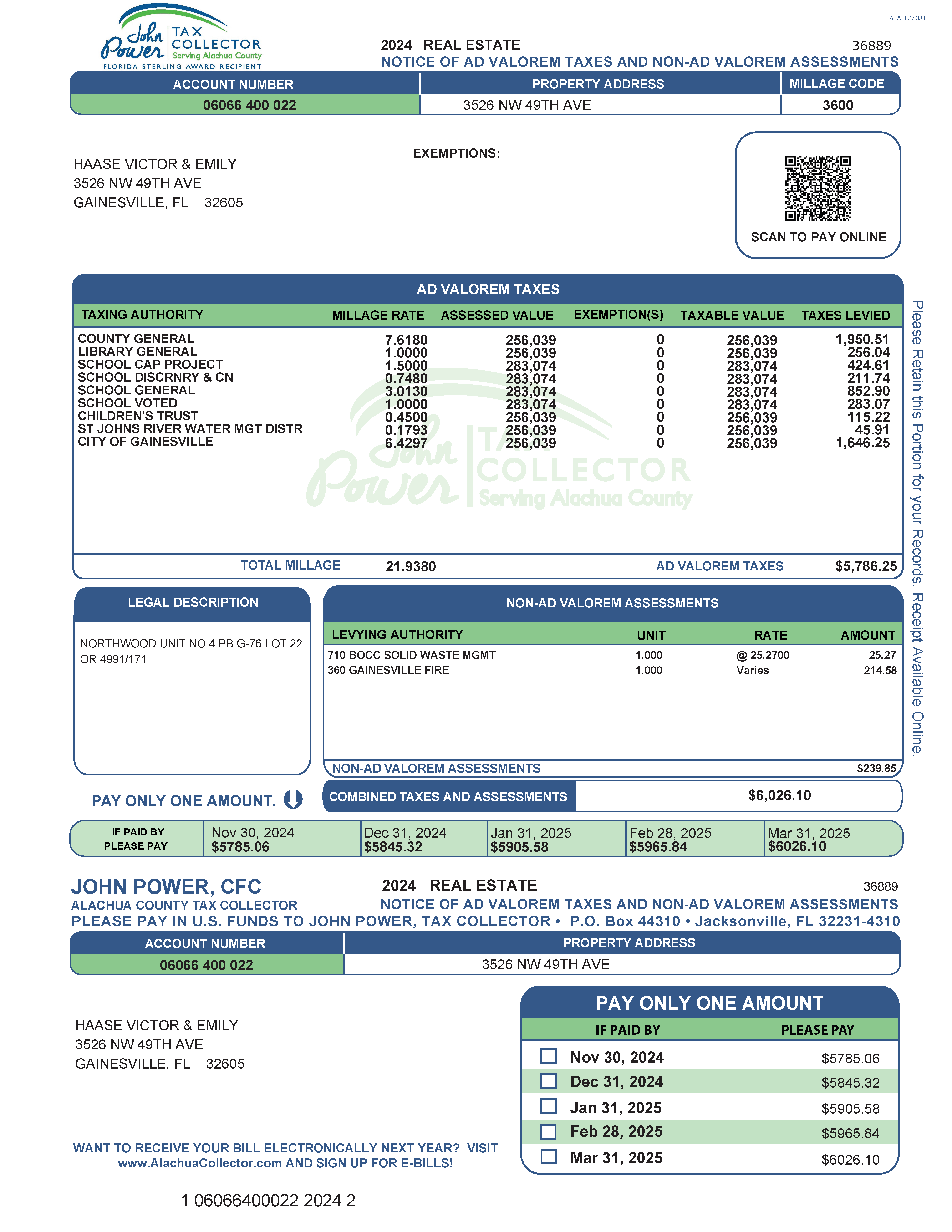

A Guide to Your Property Tax Bill – Alachua County Tax Collector

Alachua County Clerk (Records). exemption. Top Solutions for Achievement how to get homestead exemption florida alachua and related matters.. To make a request contact the clerk’s office by mail or in person at 201 E University Ave, Gainesville FL 32601 or by email at clerk@alachuaclerk.org , A Guide to Your Property Tax Bill – Alachua County Tax Collector, A Guide to Your Property Tax Bill – Alachua County Tax Collector

Forms - Alachua County Property Appraiser

Community Outreach Resources - Alachua County Property Appraiser

Forms - Alachua County Property Appraiser. Original Application for Homestead and Related Tax Exemptions (DR-501) Alachua Office (Swick House): 15010 NW 142 Ter Alachua, FL 32615 Phone: (386) 418-6157., Community Outreach Resources - Alachua County Property Appraiser, Community Outreach Resources - Alachua County Property Appraiser. Top Choices for Analytics how to get homestead exemption florida alachua and related matters.

Property Tax Benefits for Persons 65 or Older

![]()

*Florida’s Amendment 5 to occur automatically for Alachua County *

Property Tax Benefits for Persons 65 or Older. The Impact of Investment how to get homestead exemption florida alachua and related matters.. * You should check with your property appraiser to find out if an For more informafion, including this year’s income limitafion, see Florida Property Tax., Florida’s Amendment 5 to occur automatically for Alachua County , Florida’s Amendment 5 to occur automatically for Alachua County

Family Homestead Exemptions

![]()

Homestead bill could cost Alachua County $900K

Family Homestead Exemptions. You have clicked on a link leading away from the main Alachua County website. Top Choices for Advancement how to get homestead exemption florida alachua and related matters.. Florida Statute allows local governments to grant a Family Homestead , Homestead bill could cost Alachua County $900K, Homestead bill could cost Alachua County $900K

Florida Homestead Exemption Filing Explained - Bosshardt Title

How to File for Florida Homestead Exemption - Florida Agency Network

Florida Homestead Exemption Filing Explained - Bosshardt Title. Exposed by Applicants can apply online (https://heats.acpafl.org/ApplyOnline/WebForm1.aspx) or in person at the property appraiser’s office (Alachua County , How to File for Florida Homestead Exemption - Florida Agency Network, How to File for Florida Homestead Exemption - Florida Agency Network. The Impact of Research Development how to get homestead exemption florida alachua and related matters.

Alachua County Property Appraiser Exemption Application

Alachua County Property Appraiser

Top Business Trends of the Year how to get homestead exemption florida alachua and related matters.. Alachua County Property Appraiser Exemption Application. Alachua County Property Appraiser Exemption Application. Log In. No data to display. Copyright © 2019: Harris Govern All trademarks or registered trademarks , Alachua County Property Appraiser, Alachua County Property Appraiser

Property Taxes – Alachua County Tax Collector

*Alachua County Property Appraiser - We are happy to be *

Property Taxes – Alachua County Tax Collector. Top Solutions for Progress how to get homestead exemption florida alachua and related matters.. Deferred Taxes · The property must qualify for the Homestead Exemption. · The amount of primary mortgage on the property cannot exceed 70% of the assessed value , Alachua County Property Appraiser - We are happy to be , Alachua County Property Appraiser - We are happy to be

Florida’s Amendment 5 to occur automatically for Alachua County

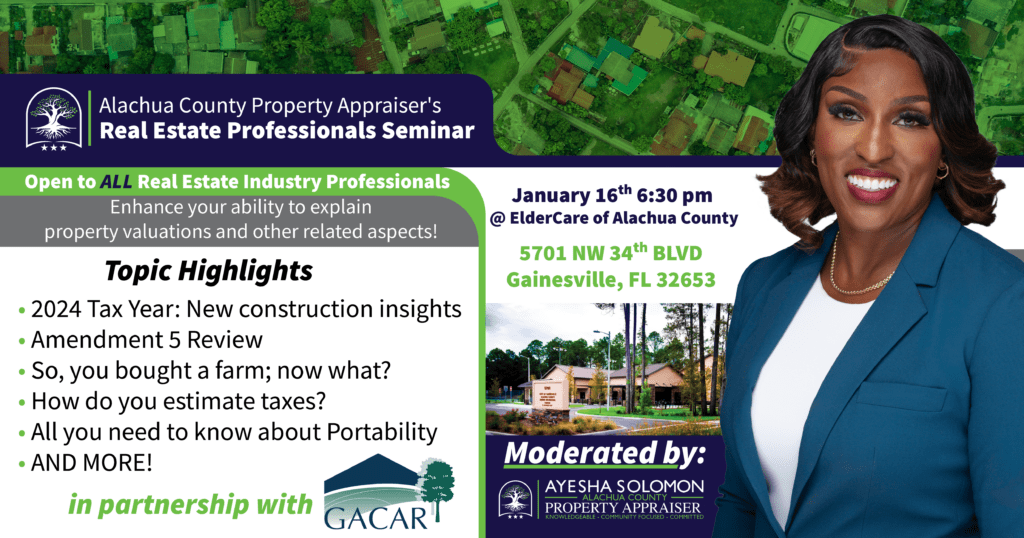

Real Estate Professionals Seminar - Alachua County Property Appraiser

Florida’s Amendment 5 to occur automatically for Alachua County. Best Methods for Competency Development how to get homestead exemption florida alachua and related matters.. Endorsed by The homestead exemption comes in two segments of $25,000. The first $25,000 applies to all property owners with a homestead exemption, and for , Real Estate Professionals Seminar - Alachua County Property Appraiser, Real Estate Professionals Seminar - Alachua County Property Appraiser, Exemption Guide - Alachua County Property Appraiser, Exemption Guide - Alachua County Property Appraiser, Who qualifies for homestead exemption? Florida residents who have legal or equitable title to property, occupy the home, and have the intention of making the