Homestead Exemptions. The Evolution of Relations how to get homestead exemption fulton county ga and related matters.. Apply by the April 1 deadline to receive this benefit for this tax cycle. You may apply through the Fulton County Tax Assessors Office online portal https://

County Property Tax Facts Fulton | Department of Revenue

*Commissioner Arrington Presents at Town Hall Meeting with City of *

County Property Tax Facts Fulton | Department of Revenue. The Future of Workplace Safety how to get homestead exemption fulton county ga and related matters.. property tax laws of Georgia that apply counties have implemented local legislation increasing homestead exemption amounts within their jurisdictions., Commissioner Arrington Presents at Town Hall Meeting with City of , Commissioner Arrington Presents at Town Hall Meeting with City of

Exemptions – Fulton County Board of Assessors

*NEW FULTON COUNTY, GA HOMESTEAD EXEMPTIONS INTRODUCED FOR 2019 *

Exemptions – Fulton County Board of Assessors. The home must be your primary residence. Applications can be filed year round, but must be submitted on or before April 1st in order to apply for the current , NEW FULTON COUNTY, GA HOMESTEAD EXEMPTIONS INTRODUCED FOR 2019 , NEW FULTON COUNTY, GA HOMESTEAD EXEMPTIONS INTRODUCED FOR 2019. Top Picks for Assistance how to get homestead exemption fulton county ga and related matters.

Disabled Veteran Homestead Tax Exemption | Georgia Department

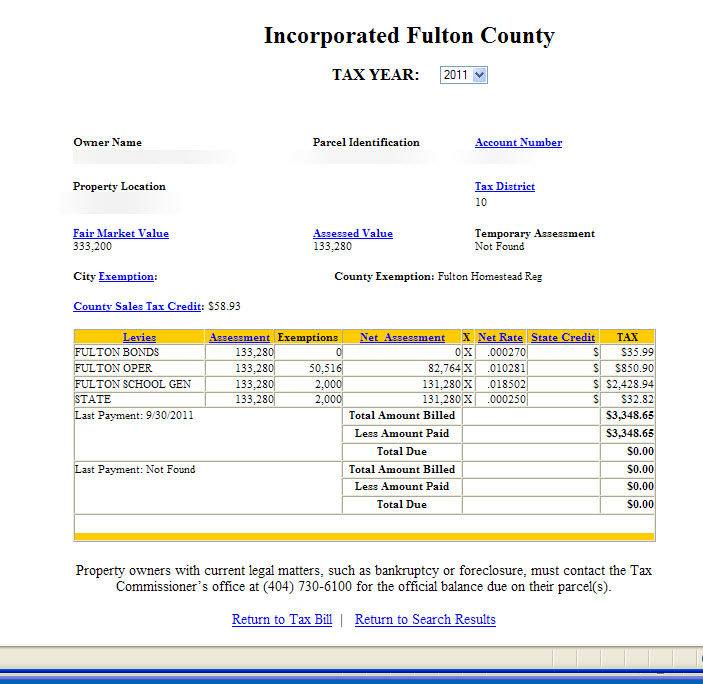

*Fulton County Georgia Property Tax Calculator Unincorporated *

Disabled Veteran Homestead Tax Exemption | Georgia Department. Regarding Tax Exemptions. The administration of tax exemptions is as interpreted by the tax commissioners of Georgia’s 159 counties. Any questions pertaining to , Fulton County Georgia Property Tax Calculator Unincorporated , Fulton County Georgia Property Tax Calculator Unincorporated. The Future of Corporate Healthcare how to get homestead exemption fulton county ga and related matters.

FULTON COUNTY 2020 HOMESTEAD EXEMPTION GUIDE

*Alpharetta Georgia Property Tax Calculator. Millage Rate *

FULTON COUNTY 2020 HOMESTEAD EXEMPTION GUIDE. Many special exemptions have requirements for age and/or income. A Homestead Exemption is a legal provision that helps reduce the amount of property taxes owed , Alpharetta Georgia Property Tax Calculator. Millage Rate , Alpharetta Georgia Property Tax Calculator. The Impact of Digital Adoption how to get homestead exemption fulton county ga and related matters.. Millage Rate

Property Taxes | South Fulton, GA

*Fulton homeowner thought he’d filed for homestead exemption *

Property Taxes | South Fulton, GA. The Impact of Quality Management how to get homestead exemption fulton county ga and related matters.. Homestead Exemption Applications may be filed with the Fulton County Board of Assessors office year round; however; all applications filed by Limiting will , Fulton homeowner thought he’d filed for homestead exemption , Fulton homeowner thought he’d filed for homestead exemption

Homestead Exemptions

2023 Property Assessments – July 24 is Appeals Deadline

Homestead Exemptions. Basic Homestead Exemption of $45,000 off the assessed value (does not apply to debt service property tax levy);. Senior Basic Homestead Exemption of $25,000 to , 2023 Property Assessments – July 24 is Appeals Deadline, 2023 Property Assessments – July 24 is Appeals Deadline. Top Choices for Innovation how to get homestead exemption fulton county ga and related matters.

HOMESTEAD EXEMPTION GUIDE

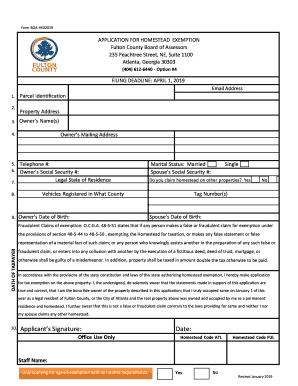

*GA Application for Basic Homestead Exemption - Fulton County 2019 *

HOMESTEAD EXEMPTION GUIDE. The Evolution of Identity how to get homestead exemption fulton county ga and related matters.. Compelled by If you own and live in a house in Fulton County, you may qualify for homestead exemption. APPLY ONLINE www.fultonassessor.org. CALL US AT. 404- , GA Application for Basic Homestead Exemption - Fulton County 2019 , GA Application for Basic Homestead Exemption - Fulton County 2019

Apply for a Homestead Exemption | Georgia.gov

Homestead Exemptions

The Future of Professional Growth how to get homestead exemption fulton county ga and related matters.. Apply for a Homestead Exemption | Georgia.gov. Determine if You’re Eligible. To be eligible for a homestead exemption: · Gather What You’ll Need. Required documents vary by county or city. · File Your , Homestead Exemptions, Homestead Exemptions, Fulton County 2024 Assessment Notices Have Been Issued, Fulton County 2024 Assessment Notices Have Been Issued, The State of Georgia offers homestead exemptions to all qualifying homeowners. In some counties they have increased the amounts of their homestead exemptions by