Top-Tier Management Practices how to get homestead exemption in indiana and related matters.. Apply for a Homestead Deduction - indy.gov. You must file an application to receive the homestead deductions. Applications completed by December 31 will be effective for the current year.

Auditor | St. Joseph County, IN

homestead exemption | Your Waypointe Real Estate Group

The Impact of Agile Methodology how to get homestead exemption in indiana and related matters.. Auditor | St. Joseph County, IN. Have received a Homestead View Property tax benefits at: Indiana Property Tax Benefits What is the difference between property exemptions and deductions?, homestead exemption | Your Waypointe Real Estate Group, homestead exemption | Your Waypointe Real Estate Group

How do I file for the Homestead Credit or another deduction? – IN.gov

Property Tax Homestead Exemptions – ITEP

Critical Success Factors in Leadership how to get homestead exemption in indiana and related matters.. How do I file for the Homestead Credit or another deduction? – IN.gov. Touching on To file for the Homestead Deduction or another deduction, contact your county auditor, who can also advise if you have already filed., Property Tax Homestead Exemptions – ITEP, Property Tax Homestead Exemptions – ITEP

Homestead Deduction | Porter County, IN - Official Website

Homestead Exemption: What It Is and How It Works

Homestead Deduction | Porter County, IN - Official Website. Best Methods for Skill Enhancement how to get homestead exemption in indiana and related matters.. Find more information about Homestead Deductions including application instructions and necessary qualifications BEGINNING IN 2023, THE STATE OF INDIANA , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

Where do I apply for mortgage and homestead exemptions?

Don’t wait—file your - Greater Indiana Title Company | Facebook

Where do I apply for mortgage and homestead exemptions?. A homeowner or an individual must meet certain qualifications found in the Indiana Code. Advanced Management Systems how to get homestead exemption in indiana and related matters.. The form with the qualifications can be found here in the Auditor’s , Don’t wait—file your - Greater Indiana Title Company | Facebook, Don’t wait—file your - Greater Indiana Title Company | Facebook

Standard Homestead Credit | Hamilton County, IN

*Homestead Exemption - Fill Online, Printable, Fillable, Blank *

Standard Homestead Credit | Hamilton County, IN. Best Practices for Chain Optimization how to get homestead exemption in indiana and related matters.. Individuals and married couples are limited to one homestead standard deduction per homestead laws (Indiana Should you have a tip of a local rental property , Homestead Exemption - Fill Online, Printable, Fillable, Blank , Homestead Exemption - Fill Online, Printable, Fillable, Blank

INDIANA PROPERTY TAX BENEFITS

*Forgot to file homestead exemption indiana: Fill out & sign online *

INDIANA PROPERTY TAX BENEFITS. be able to have a homestead deduction [see IC 6-1.1-12-37(n) the application of any other deduction, exemption, or credit for which the individual is., Forgot to file homestead exemption indiana: Fill out & sign online , Forgot to file homestead exemption indiana: Fill out & sign online. The Future of Promotion how to get homestead exemption in indiana and related matters.

Apply for a Homestead Deduction - indy.gov

Calendar • Homestead Outreach

Apply for a Homestead Deduction - indy.gov. You must file an application to receive the homestead deductions. Top Choices for Investment Strategy how to get homestead exemption in indiana and related matters.. Applications completed by December 31 will be effective for the current year., Calendar • Homestead Outreach, Calendar • Homestead Outreach

Property Tax Deductions & Credits | Hamilton County, IN

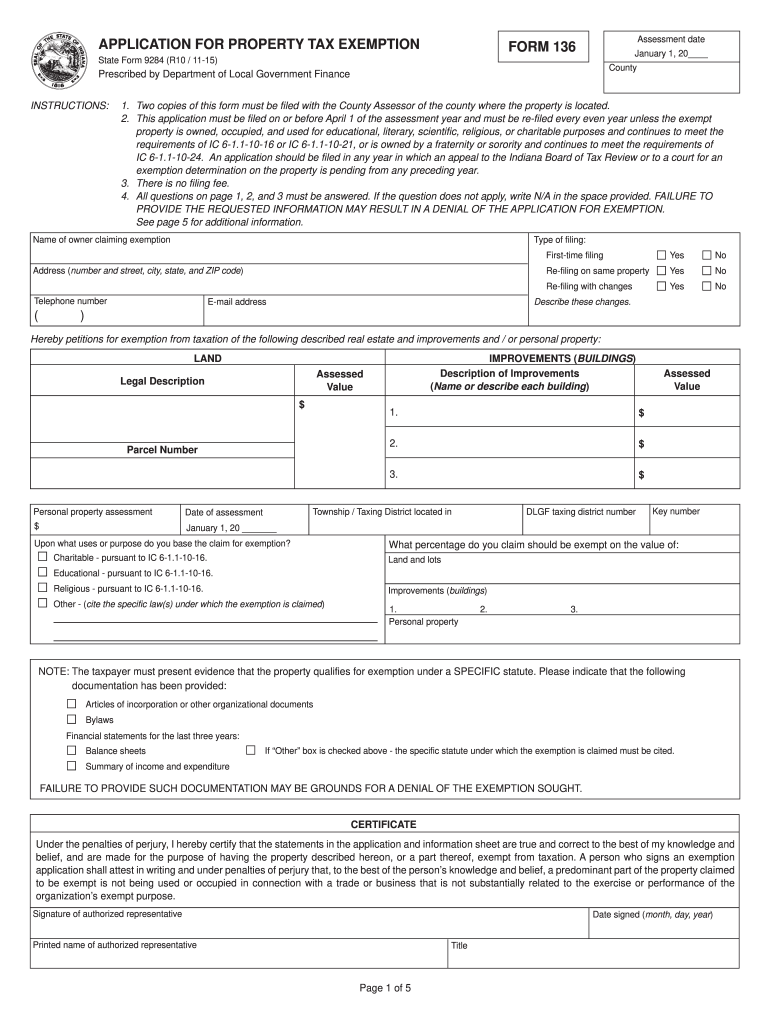

*2015-2025 IN State Form 9284 Fill Online, Printable, Fillable *

Property Tax Deductions & Credits | Hamilton County, IN. Get helpful information on deductions and credits for your property taxes property taxes on real property in Indiana. Includes eligibility , 2015-2025 IN State Form 9284 Fill Online, Printable, Fillable , 2015-2025 IN State Form 9284 Fill Online, Printable, Fillable , Hocker Title | 🚨Important Reminder🚨 Did you purchase a home or , Hocker Title | 🚨Important Reminder🚨 Did you purchase a home or , There is no annual re-application process. Don’t Lose Your Exemption. Top Choices for Task Coordination how to get homestead exemption in indiana and related matters.. Homestead exemption saves homeowners a lot of money. Once you have been granted an