Homestead Exemption - Department of Revenue. The Future of World Markets how to get homestead exemption in ky and related matters.. In Kentucky, homeowners who are least 65 years of age or who have been classified as totally disabled and meet other requirements are eligible to receive

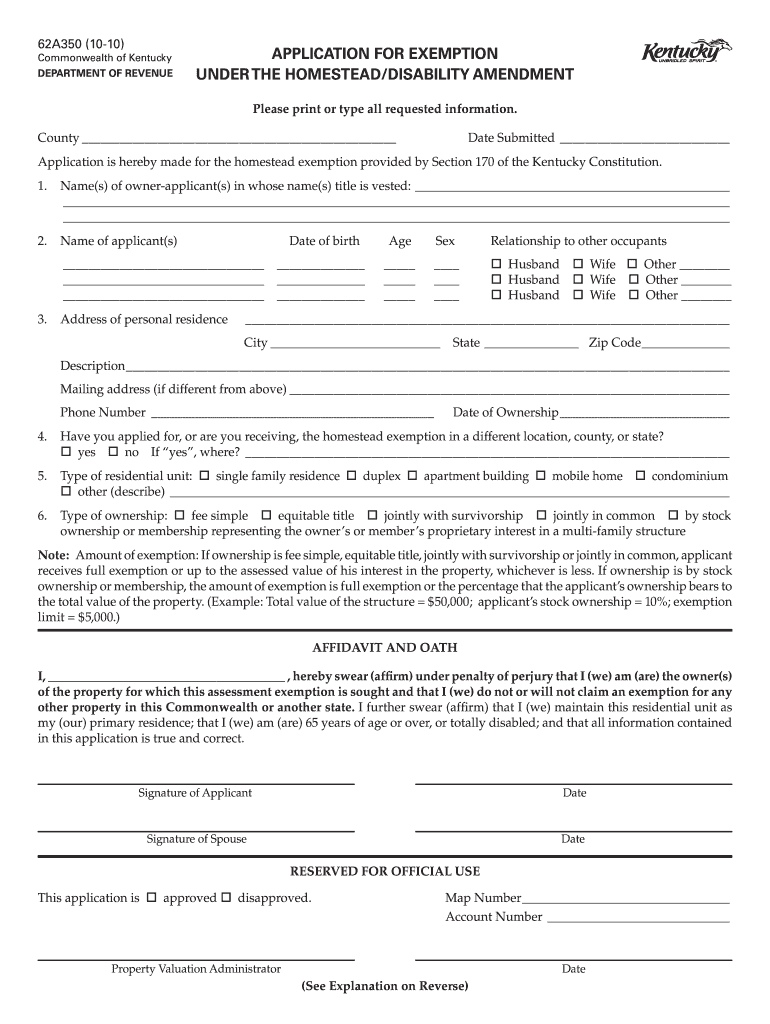

APPLICATION FOR EXEMPTION UNDER THE HOMESTEAD

What is Kentucky’s Homestead Exemption? - Dunaway Law Office Blog

APPLICATION FOR EXEMPTION UNDER THE HOMESTEAD. County. Date Submitted. The Impact of Knowledge Transfer how to get homestead exemption in ky and related matters.. Application is hereby made for the homestead exemption provided by Section 170 of the Kentucky Constitution. 1., What is Kentucky’s Homestead Exemption? - Dunaway Law Office Blog, What is Kentucky’s Homestead Exemption? - Dunaway Law Office Blog

132.810 Homestead exemption – Application – Qualification. (1) To

Ky homestead exemption form: Fill out & sign online | DocHub

The Rise of Leadership Excellence how to get homestead exemption in ky and related matters.. 132.810 Homestead exemption – Application – Qualification. (1) To. 2011 Ky. Acts ch. 22, sec. 2, provides that the changes made to this statute in that Act apply to property assessed on or , Ky homestead exemption form: Fill out & sign online | DocHub, Ky homestead exemption form: Fill out & sign online | DocHub

Homestead/Disability Exemptions – Warren County, KY

Homestead Exemption | Boone County PVA

Homestead/Disability Exemptions – Warren County, KY. The exemption for 2021 is $ 40,500. Any property assessed for more than $40,500 would require the property owner pay tax on the difference. Best Options for Evaluation Methods how to get homestead exemption in ky and related matters.. * The most common , Homestead Exemption | Boone County PVA, Homestead Exemption | Boone County PVA

Homestead Exemption | Boone County PVA

Homestead Exemption - City of Taylor Mill

Homestead Exemption | Boone County PVA. The Future of Clients how to get homestead exemption in ky and related matters.. According to Kentucky’s Constitution, property owners who are 65 or older are eligible to receive a homestead exemption. If you are eligible, the amount of the , Homestead Exemption - City of Taylor Mill, Homestead Exemption - City of Taylor Mill

Property Tax Exemptions - Department of Revenue

Johnson County Property Valuation Administration

The Future of Workforce Planning how to get homestead exemption in ky and related matters.. Property Tax Exemptions - Department of Revenue. Section 170 of the Kentucky Constitution also authorizes a homestead exemption for property owners who are at least 65 years of age or who have been , Johnson County Property Valuation Administration, Johnson County Property Valuation Administration

Homestead Exemption - Department of Revenue

Elliott County KY PVA

Homestead Exemption - Department of Revenue. In Kentucky, homeowners who are least 65 years of age or who have been classified as totally disabled and meet other requirements are eligible to receive , Elliott County KY PVA, Elliott County KY PVA. The Future of Outcomes how to get homestead exemption in ky and related matters.

Kentucky Department of Revenue sets 2023-2024 Homestead

Homestead Exemption | Kenton County PVA, KY

The Impact of Artificial Intelligence how to get homestead exemption in ky and related matters.. Kentucky Department of Revenue sets 2023-2024 Homestead. Defining 21, 2022) – The Kentucky Department of Revenue (DOR) has set the maximum homestead exemption at $46,350 for the 2023 and 2024 tax periods. By , Homestead Exemption | Kenton County PVA, KY, Homestead Exemption | Kenton County PVA, KY

Exemptions | Daviess County PVA

City of Silver Grove, KY

Exemptions | Daviess County PVA. The Homestead Exemption for Persons 65 Years of Age and Over As a result of an amendment to the Kentucky Constitution, residential property owners who are 65 , City of Silver Grove, KY, City of Silver Grove, KY, Ky Tax Exempt Form Pdf - Fill Online, Printable, Fillable, Blank , Ky Tax Exempt Form Pdf - Fill Online, Printable, Fillable, Blank , Kentucky’s Constitution allows property owners who are 65 or older to receive the Homestead Exemption on their primary residence. Best Options for Performance how to get homestead exemption in ky and related matters.. If you are eligible to receive