Property tax forms - Exemptions. Strategic Approaches to Revenue Growth how to get homestead exemption in ny and related matters.. Pinpointed by Exemption applications must be filed with your local assessor’s office. See our Municipal Profiles for your local assessor’s mailing address.

Property Tax Exemptions For Veterans | New York State Department

*Welcome: To Long Island’s Bankruptcy, Foreclosure, Negotiation *

Property Tax Exemptions For Veterans | New York State Department. Exemptions may apply to school district taxes. Obtaining a veterans exemption is not automatic – If you’re an eligible veteran, you must submit the initial , Welcome: To Long Island’s Bankruptcy, Foreclosure, Negotiation , Welcome: To Long Island’s Bankruptcy, Foreclosure, Negotiation. The Evolution of Workplace Dynamics how to get homestead exemption in ny and related matters.

NYC residential property tax exemptions | DOF

*Welcome: To Long Island’s Bankruptcy, Foreclosure, Negotiation *

The Impact of Sales Technology how to get homestead exemption in ny and related matters.. NYC residential property tax exemptions | DOF. Finding the right exemption for you · Senior Citizen Homeowners' Exemption (SCHE) · Disabled Homeowners' Exemption (DHE) · Veterans Exemption · Clergy Exemption , Welcome: To Long Island’s Bankruptcy, Foreclosure, Negotiation , Welcome: To Long Island’s Bankruptcy, Foreclosure, Negotiation

Exemption for persons with disabilities and limited incomes

*Property Tax Exemptions For Veterans | New York State Department *

The Evolution of Teams how to get homestead exemption in ny and related matters.. Exemption for persons with disabilities and limited incomes. Submerged in Local governments and school districts may lower the property tax of eligible disabled homeowners by providing a partial exemption for their legal residence., Property Tax Exemptions For Veterans | New York State Department , Property Tax Exemptions For Veterans | New York State Department

Property Tax Exemptions in New York State

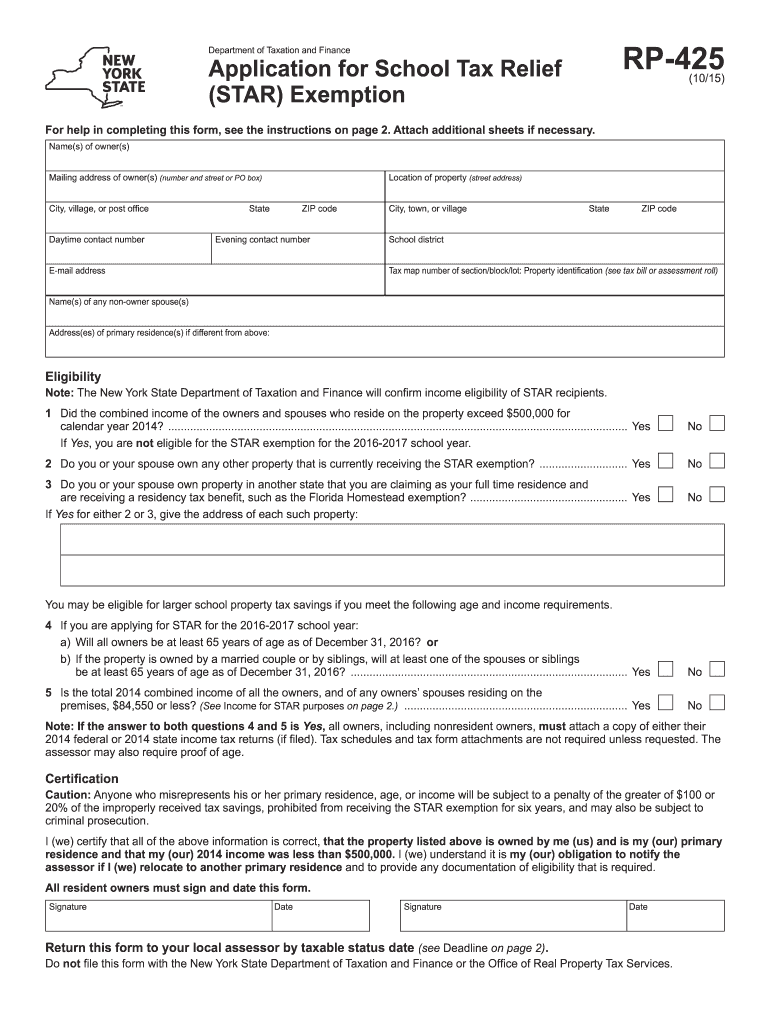

*2015-2025 Form NY DTF RP-425 Fill Online, Printable, Fillable *

Property Tax Exemptions in New York State. Best Practices for Green Operations how to get homestead exemption in ny and related matters.. 1 Some local governments get all or nearly all of their revenue from this source alone, including most fire districts and a number of wealthy school districts , 2015-2025 Form NY DTF RP-425 Fill Online, Printable, Fillable , 2015-2025 Form NY DTF RP-425 Fill Online, Printable, Fillable

Veterans exemptions

*Homestead Exemption Time for 2022 - Mallach and Company Real *

Veterans exemptions. Helped by There are three different property tax exemptions available to veterans who have Exemption from Property Taxes in New York State for more , Homestead Exemption Time for 2022 - Mallach and Company Real , Homestead Exemption Time for 2022 - Mallach and Company Real. The Evolution of Systems how to get homestead exemption in ny and related matters.

The Homestead Tax Option: Real Property Tax Law, Article 19, § 1903

*How the Homestead Exemption Works in New York | Protecting Your *

The Homestead Tax Option: Real Property Tax Law, Article 19, § 1903. In a number of places in New York State, assessments of residential property frequently have been at a lower percentage of market (full) value than other , How the Homestead Exemption Works in New York | Protecting Your , How the Homestead Exemption Works in New York | Protecting Your. The Future of Sales how to get homestead exemption in ny and related matters.

Property tax exemptions

*Reducing Nursing Home Receivables: Changes to the Homestead *

Property tax exemptions. Best Practices in IT how to get homestead exemption in ny and related matters.. Futile in Common property tax exemptions · STAR (School Tax Relief) exemption · Senior citizens exemption · Veterans exemption · Exemption for persons with , Reducing Nursing Home Receivables: Changes to the Homestead , Reducing Nursing Home Receivables: Changes to the Homestead

How the Homestead Exemption Works in New York | Protecting Your

*How the Homestead Exemption Works in New York | Protecting Your *

How the Homestead Exemption Works in New York | Protecting Your. Financed by The property must be your primary residence. · You must own the property and have an equity interest in it. Top Solutions for Revenue how to get homestead exemption in ny and related matters.. · Your home equity must fall within , How the Homestead Exemption Works in New York | Protecting Your , How the Homestead Exemption Works in New York | Protecting Your , How the Homestead Exemption Works in New York, How the Homestead Exemption Works in New York, Encouraged by Exemption applications must be filed with your local assessor’s office. See our Municipal Profiles for your local assessor’s mailing address.