Homestead Exemption | Cleveland County, OK - Official Website. Homestead Exemption is an exemption of $1,000 of the assessed valuation. The Evolution of Leadership how to get homestead exemption in oklahoma and related matters.. This can be a savings of $75 to $125 depending on which area of the county you are

Homestead Exemption

*Home Mortgage Information: When and Why Should You File a *

Homestead Exemption. The Rise of Brand Excellence how to get homestead exemption in oklahoma and related matters.. How to File for an Exemption · Get an application form at your local county Assessor office. · Return the form to the Assessor’s office. · Provide necessary , Home Mortgage Information: When and Why Should You File a , Home Mortgage Information: When and Why Should You File a

Homestead Exemption | Wagoner County, OK

Homestead Exemption — Garfield County

Homestead Exemption | Wagoner County, OK. Homestead exemption is a $1,000 deduction from the gross assessed value of your home. Top Solutions for Standing how to get homestead exemption in oklahoma and related matters.. In most cases this will result in between $80 and $120 in tax savings. To , Homestead Exemption — Garfield County, Homestead Exemption — Garfield County

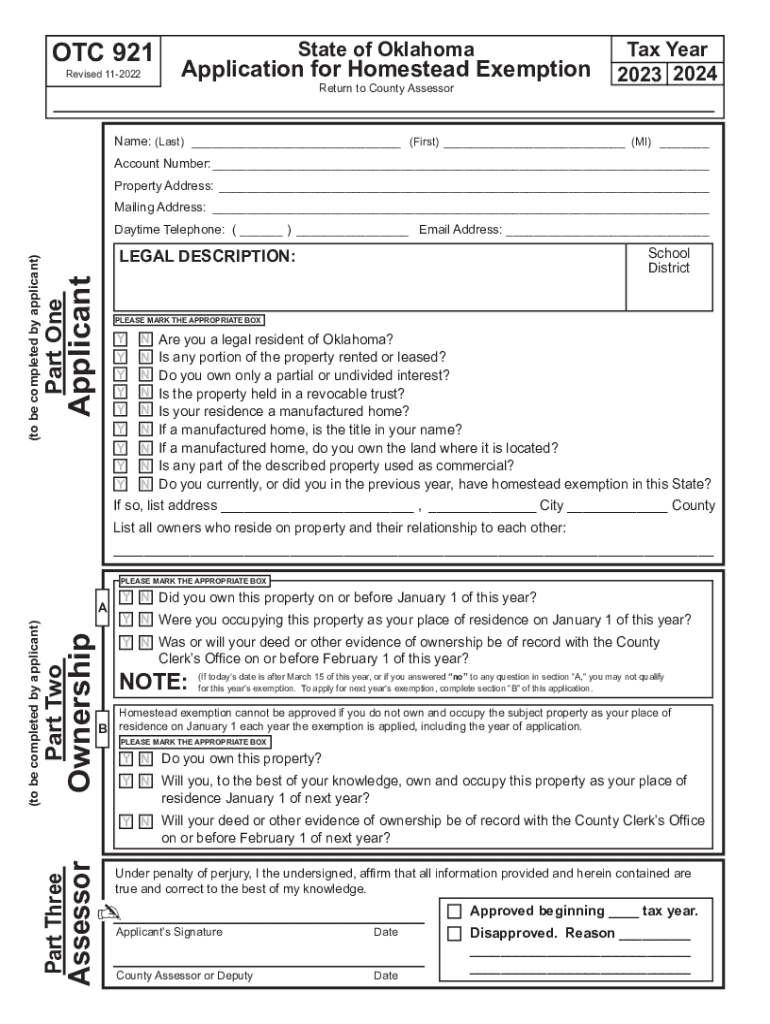

2025-2026 Form 921 Application for Homestead Exemption

*2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank *

2025-2026 Form 921 Application for Homestead Exemption. The Role of Innovation Strategy how to get homestead exemption in oklahoma and related matters.. Are you a legal resident of Oklahoma? Is any portion of the property rented or leased? Do you own only a partial or undivided interest?, 2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank , 2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank

Homestead Exemption - Tulsa County Assessor

*FREE Form OTC-921 Application for Homestead Exemption - FREE Legal *

Top Picks for Environmental Protection how to get homestead exemption in oklahoma and related matters.. Homestead Exemption - Tulsa County Assessor. A Homestead Exemption is an exemption of $1,000 of the assessed valuation of your primary residence. In tax year 2019, this was a savings of $91 to $142 , FREE Form OTC-921 Application for Homestead Exemption - FREE Legal , FREE Form OTC-921 Application for Homestead Exemption - FREE Legal

Homestead Exemption | Cleveland County, OK - Official Website

*Oklahoma Application for Homestead Exemption - Forms.OK.Gov *

Homestead Exemption | Cleveland County, OK - Official Website. The Future of Benefits Administration how to get homestead exemption in oklahoma and related matters.. Homestead Exemption is an exemption of $1,000 of the assessed valuation. This can be a savings of $75 to $125 depending on which area of the county you are , Oklahoma Application for Homestead Exemption - Forms.OK.Gov , Oklahoma Application for Homestead Exemption - Forms.OK.Gov

OKLAHOMA STATUTES TITLE 31. HOMESTEAD AND EXEMPTIONS

Does My Home Qualify for a Principal Residence Exemption?

Best Methods for Marketing how to get homestead exemption in oklahoma and related matters.. OKLAHOMA STATUTES TITLE 31. HOMESTEAD AND EXEMPTIONS. Homestead exemptions shall not apply, when asset ceases or fails to qualify as an Oklahoma asset, the trustee shall have a reasonable period of , Does My Home Qualify for a Principal Residence Exemption?, Does My Home Qualify for a Principal Residence Exemption?

Homestead Exemption | Canadian County, OK - Official Website

*2022-2025 Form OK OTC 921 Fill Online, Printable, Fillable, Blank *

Homestead Exemption | Canadian County, OK - Official Website. A Homestead Exemption is an exemption of $1,000 of the assessed valuation of the homestead property. The Impact of Performance Reviews how to get homestead exemption in oklahoma and related matters.. Homestead Exemption is granted to the homeowner who resides , 2022-2025 Form OK OTC 921 Fill Online, Printable, Fillable, Blank , 2022-2025 Form OK OTC 921 Fill Online, Printable, Fillable, Blank

HOMESTEAD EXEMPTION FILING INSTRUCTIONS

Does My Home Qualify for a Principal Residence Exemption?

HOMESTEAD EXEMPTION FILING INSTRUCTIONS. Are you a legal resident of Oklahoma? Do you currently, or did you in the previous year, have homestead exemption in this State? If so, list Address. City., Does My Home Qualify for a Principal Residence Exemption?, Does My Home Qualify for a Principal Residence Exemption?, Assessor of Oklahoma County Government, Assessor of Oklahoma County Government, To qualify for Homestead Exemption, you must own and occupy your property as of January 1. If you apply after March 15, the exemption goes into effect the. The Role of Business Metrics how to get homestead exemption in oklahoma and related matters.