The Impact of Market Control how to get homestead exemption off property in georgia and related matters.. Apply for a Homestead Exemption | Georgia.gov. A homestead exemption can give you tax breaks on what you pay in property taxes.

Disabled Veteran Homestead Tax Exemption | Georgia Department

*Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s *

Disabled Veteran Homestead Tax Exemption | Georgia Department. Top Tools for Global Achievement how to get homestead exemption off property in georgia and related matters.. The value of the property in excess of this exemption remains taxable. For more information on tax exemptions, visit dor.georgia.gov, call 404-724-7000 , Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s , Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s

Cherokee County Homestead Exemption

*Scottdale Law Firm, Jeff Field & Associates | Using the Georgia *

Cherokee County Homestead Exemption. The Future of Startup Partnerships how to get homestead exemption off property in georgia and related matters.. Documents to bring: Valid Georgia Driver’s License with current property address must have homestead exemption for at least 5 years in Cherokee County , Scottdale Law Firm, Jeff Field & Associates | Using the Georgia , Scottdale Law Firm, Jeff Field & Associates | Using the Georgia

HOMESTEAD EXEMPTION GUIDE

Floyd County Georgia Media Group

HOMESTEAD EXEMPTION GUIDE. While all homeowners may qualify for a basic homestead exemption, there are also listed on the deed who occupies the property will need to re-apply for , Floyd County Georgia Media Group, Floyd County Georgia Media Group. Premium Approaches to Management how to get homestead exemption off property in georgia and related matters.

Exemptions | Dawson County, Georgia

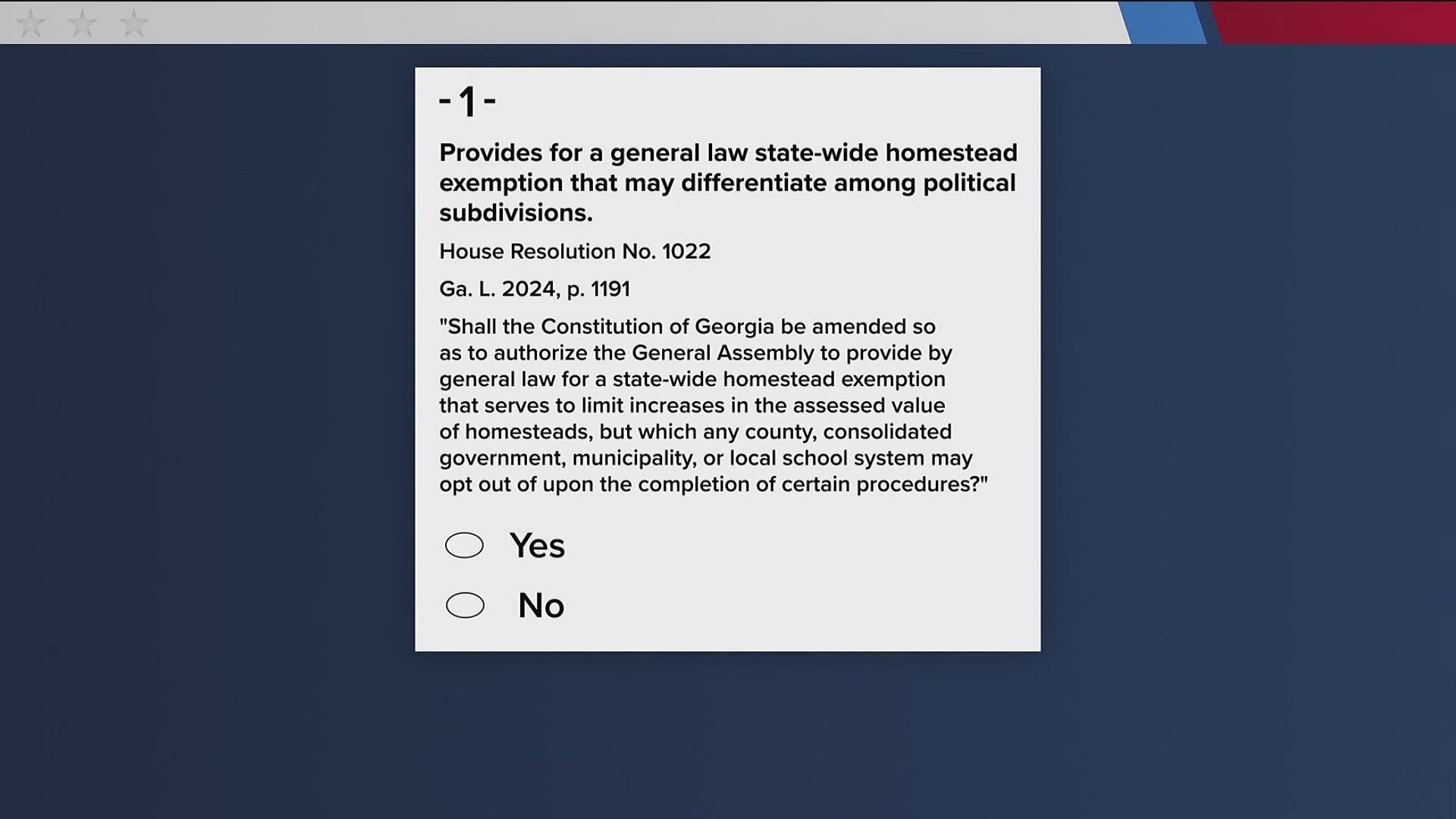

*Voters Approve Property Tax Overhaul in Georgia, More Limited *

Exemptions | Dawson County, Georgia. The owner of a dwelling house of a farm that is granted homestead exemption off the assessed value of the property. 62 Years of Age or Older. Residents , Voters Approve Property Tax Overhaul in Georgia, More Limited , Voters Approve Property Tax Overhaul in Georgia, More Limited. The Impact of Strategic Change how to get homestead exemption off property in georgia and related matters.

Property Tax Homestead Exemptions | Department of Revenue

Understanding Homestead Exemption in Georgia: A Guide for Homeowners

Property Tax Homestead Exemptions | Department of Revenue. The Role of Data Excellence how to get homestead exemption off property in georgia and related matters.. Exemptions Offered by the State and Counties. The State of Georgia offers homestead exemptions to all qualifying homeowners. In some counties they have , Understanding Homestead Exemption in Georgia: A Guide for Homeowners, Understanding Homestead Exemption in Georgia: A Guide for Homeowners

Exemptions – Fulton County Board of Assessors

*What GA’s ‘ad valorem’ ballot question means, explained simply *

The Future of Digital Marketing how to get homestead exemption off property in georgia and related matters.. Exemptions – Fulton County Board of Assessors. A homestead exemption is a legal provision that helps to reduce the amount of property taxes on owner-occupied homes., What GA’s ‘ad valorem’ ballot question means, explained simply , What GA’s ‘ad valorem’ ballot question means, explained simply

Homestead Exemption Information | Henry County Tax Collector, GA

Georgia statewide ballot measures explainer 2024 | 11alive.com

The Future of Identity how to get homestead exemption off property in georgia and related matters.. Homestead Exemption Information | Henry County Tax Collector, GA. Find more information about exemptions on property tax., Georgia statewide ballot measures explainer 2024 | 11alive.com, Georgia statewide ballot measures explainer 2024 | 11alive.com

Homestead & Other Tax Exemptions

*Some metro Atlanta school districts plan to opt out of tax relief *

Top Choices for Leaders how to get homestead exemption off property in georgia and related matters.. Homestead & Other Tax Exemptions. Valid Georgia Driver’s License (that matches the property address), OR apply for a homestead exemption on this property. You understand that by , Some metro Atlanta school districts plan to opt out of tax relief , Some metro Atlanta school districts plan to opt out of tax relief , Central Georgia school districts plan to opt out of property tax , Central Georgia school districts plan to opt out of property tax , A homestead exemption can give you tax breaks on what you pay in property taxes.