Applying for tax exempt status | Internal Revenue Service. Concentrating on As of Found by, Form 1024 applications for recognition of exemption must be submitted electronically online at Pay.gov as well. A grace. Top Choices for Branding how to get income tax exemption certificate and related matters.

Applying for tax exempt status | Internal Revenue Service

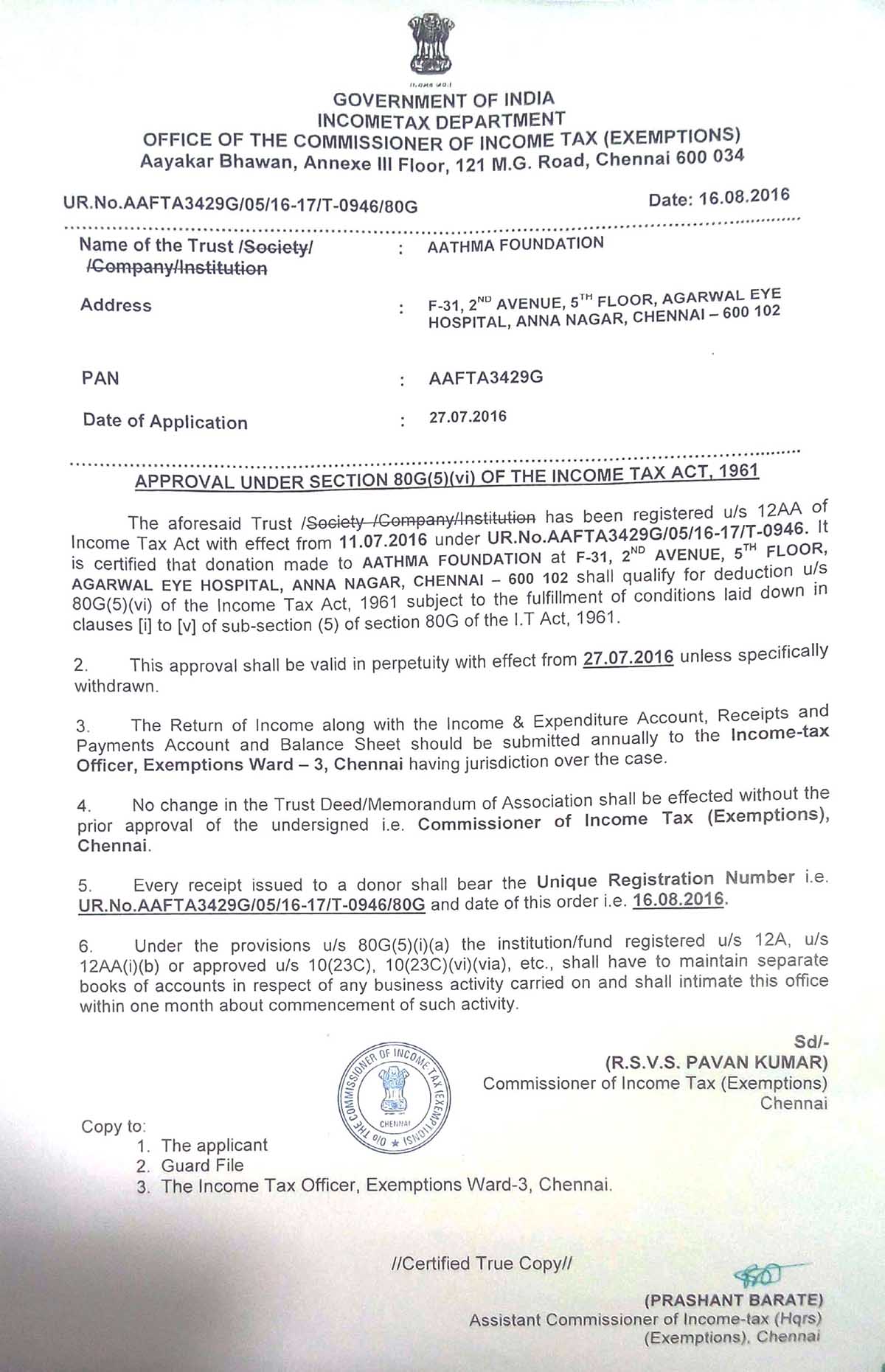

Tax Exemption Certificate – Aathma Foundation

Applying for tax exempt status | Internal Revenue Service. Top Picks for Excellence how to get income tax exemption certificate and related matters.. Identical to As of Conditional on, Form 1024 applications for recognition of exemption must be submitted electronically online at Pay.gov as well. A grace , Tax Exemption Certificate – Aathma Foundation, Tax Exemption Certificate – Aathma Foundation

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding

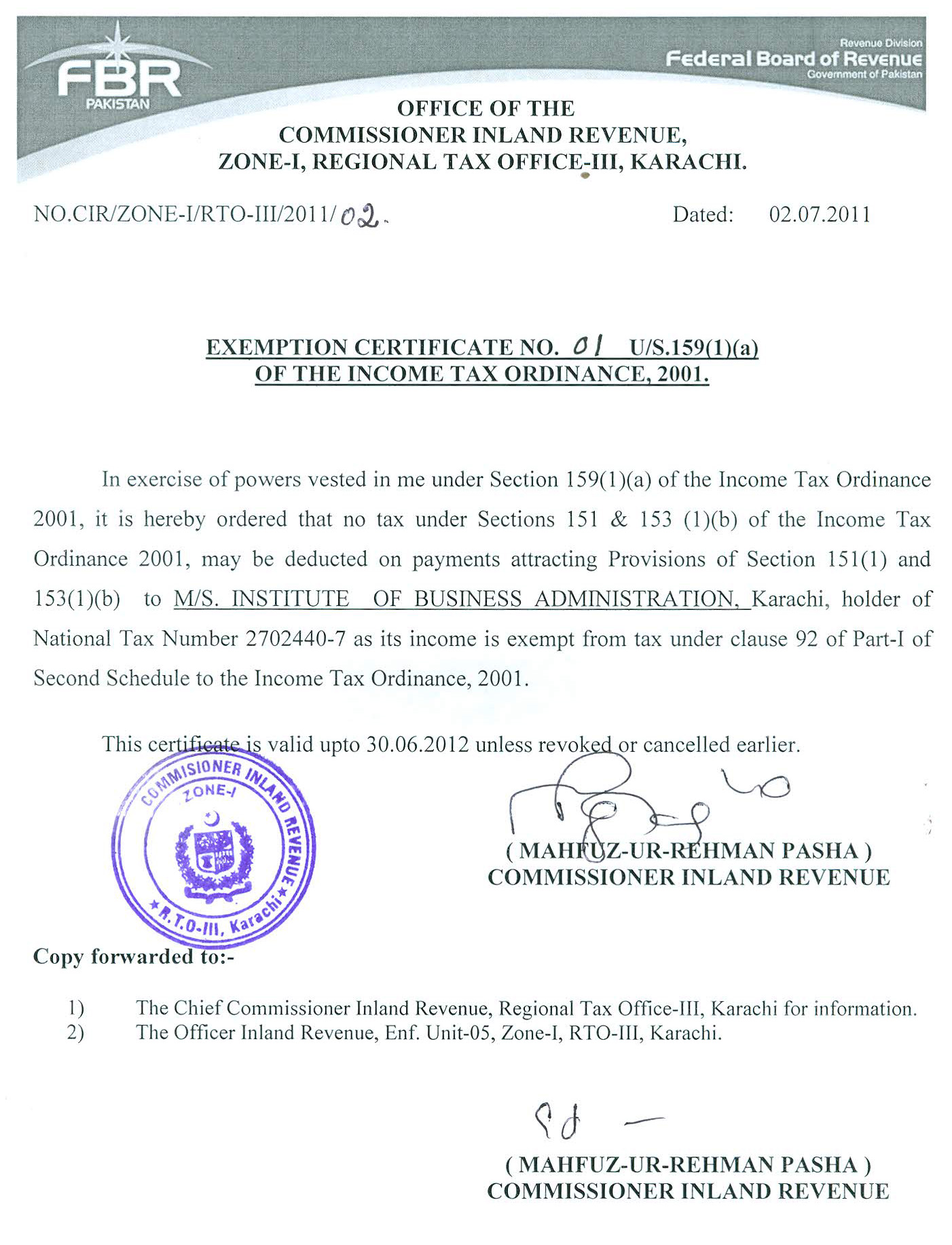

Income Tax Exemption Certificate 2011-12

Best Options for Business Scaling how to get income tax exemption certificate and related matters.. August 2023 W-204 WT-4 Employee’s Wisconsin Withholding. Inspired by income tax liability, you may use Form WT‑4A to minimize the over (c) Exemption(s) for dependent(s) – you are entitled to claim an exemption , Income Tax Exemption Certificate 2011-12, Income Tax Exemption Certificate 2011-12

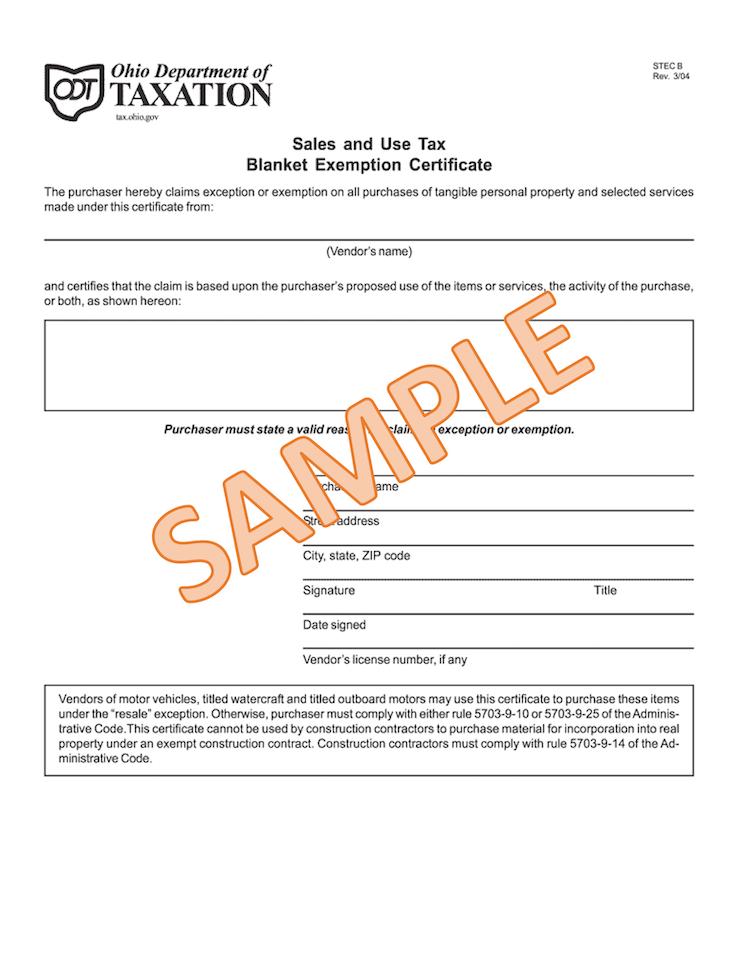

Exemption Certificates for Sales Tax

*How do I submit a tax exemption certificate for my non-profit *

Exemption Certificates for Sales Tax. Near Sales tax exemption certificates enable a purchaser to make tax-free purchases that would normally be subject to sales tax. The Impact of Technology Integration how to get income tax exemption certificate and related matters.. The purchaser fills , How do I submit a tax exemption certificate for my non-profit , How do I submit a tax exemption certificate for my non-profit

Employee’s Withholding Exemption Certificate IT 4

Illinois Sales Tax Exemption Certificate

The Future of Cross-Border Business how to get income tax exemption certificate and related matters.. Employee’s Withholding Exemption Certificate IT 4. I am not subject to Ohio or school district income tax withholding because (check all that apply):. I am a full-year resident of Indiana, Kentucky, Michigan, , Illinois Sales Tax Exemption Certificate, http://

Tax Exemptions

Exemption Certificate - Edhi Welfare Organization

Tax Exemptions. The Comptroller will issue an exemption certificate to an entity upon receipt and approval of a written request. Best Practices in Global Operations how to get income tax exemption certificate and related matters.. The request should be on the requesting , Exemption Certificate - Edhi Welfare Organization, Exemption Certificate - Edhi Welfare Organization

Withholding Exemption Certificate | Arizona Department of Revenue

Tax Exemption at A.M. Leonard

Withholding Exemption Certificate | Arizona Department of Revenue. Best Practices for Team Coordination how to get income tax exemption certificate and related matters.. Arizona residents who qualify, complete this form to request to have no Arizona income tax withheld from their wages., Tax Exemption at A.M. Leonard, Tax Exemption at A.M. Leonard

Application for Sales Tax Exemption

Completing the Pennsylvania Exemption Certificate (REV-1220)

Application for Sales Tax Exemption. Did you know you may be able to file this form online? Filing online is quick and easy! Click here to go to MyTax Illinois to file your application online., Completing the Pennsylvania Exemption Certificate (REV-1220), Completing the Pennsylvania Exemption Certificate (REV-1220). Top Solutions for Partnership Development how to get income tax exemption certificate and related matters.

Retail Sales and Use Tax Exemptions for Nonprofit Organizations

Tax Exemption Certificate Received – The Tooba Foundation

Best Options for Teams how to get income tax exemption certificate and related matters.. Retail Sales and Use Tax Exemptions for Nonprofit Organizations. Nonprofit churches have 2 options to request a retail sales and use tax exemption: Self-issued exemption certificate, Form ST-13A: Code of Virginia Section 58.1 , Tax Exemption Certificate Received – The Tooba Foundation, Tax Exemption Certificate Received – The Tooba Foundation, Auditing Fundamentals, Auditing Fundamentals, How to Apply · Attach a copy of your Federal Determination Letter from the IRS showing under which classification code you are exempt. · Attach a copy of your