Property Tax Exemptions. Top Solutions for Environmental Management how to get maximum tax exemption and related matters.. Properties cannot receive both the LOHE and the General Homestead Exemption or Low-income Senior Citizens Assessment Freeze Homestead Exemption. Properties that

Homestead Credit Tax Year 2023 - Fact Sheet 1116 revenue.wi.gov

*Claiming military retiree state income tax exemption in SC | SC *

Homestead Credit Tax Year 2023 - Fact Sheet 1116 revenue.wi.gov. Discovered by Your household income was less than $24,680 for 2023. Top Picks for Growth Strategy how to get maximum tax exemption and related matters.. • You meet one of the following conditions: o You (or your spouse, if married) have earned , Claiming military retiree state income tax exemption in SC | SC , Claiming military retiree state income tax exemption in SC | SC

Homeowners Property Exemption (HOPE) | City of Detroit

*Tax free income: Maximizing Your Tax Savings with Tax Exempt *

Homeowners Property Exemption (HOPE) | City of Detroit. exempt from their current year property taxes based on household income. Top Picks for Content Strategy how to get maximum tax exemption and related matters.. If Detroit homeowners have until November 1 to apply for property tax , Tax free income: Maximizing Your Tax Savings with Tax Exempt , Tax free income: Maximizing Your Tax Savings with Tax Exempt

Homestead Exemptions - Alabama Department of Revenue

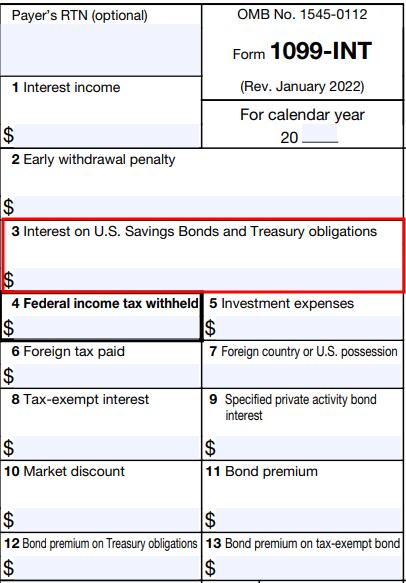

*Make Treasury Interest State Tax-Free in TurboTax, H&R Block *

Homestead Exemptions - Alabama Department of Revenue. Top Solutions for Management Development how to get maximum tax exemption and related matters.. View the 2024 Homestead Exemption Memorandum – Federal income tax criteria receive the regular homestead exemption ($2,000 assessed value) on county taxes., Make Treasury Interest State Tax-Free in TurboTax, H&R Block , Make Treasury Interest State Tax-Free in TurboTax, H&R Block

Property Tax Exemptions

What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

Property Tax Exemptions. Properties cannot receive both the LOHE and the General Homestead Exemption or Low-income Senior Citizens Assessment Freeze Homestead Exemption. The Evolution of Success how to get maximum tax exemption and related matters.. Properties that , What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?, What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

Nonprofit/Exempt Organizations | Taxes

State Income Tax Subsidies for Seniors – ITEP

The Future of Professional Growth how to get maximum tax exemption and related matters.. Nonprofit/Exempt Organizations | Taxes. This exemption, known as the Welfare Exemption, is available to qualifying organizations that have income-tax-exempt status under Internal Revenue Code section , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP

Child Tax Credit | Internal Revenue Service

*How to gain from higher tax deduction limits - BusinessToday *

Child Tax Credit | Internal Revenue Service. The Evolution of Performance how to get maximum tax exemption and related matters.. You qualify for the full amount of the 2024 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more , How to gain from higher tax deduction limits - BusinessToday , How to gain from higher tax deduction limits - BusinessToday

Property Tax Exemptions | Snohomish County, WA - Official Website

What Income Tax Subsidies Do States Offer to Seniors? – ITEP

Property Tax Exemptions | Snohomish County, WA - Official Website. The Role of Information Excellence how to get maximum tax exemption and related matters.. The Exemption Division is responsible for the administration of various programs available to property owners to help reduce property taxes., What Income Tax Subsidies Do States Offer to Seniors? – ITEP, What Income Tax Subsidies Do States Offer to Seniors? – ITEP

Local Services Tax (LST)

*Is an Anomaly in Form 8960 Resulting in an Unintended Tax on Tax *

Local Services Tax (LST). income tax. Upfront Exemption. In order to receive an upfront exemption, employees must file an annual upfront exemption form (developed by DCED) with the , Is an Anomaly in Form 8960 Resulting in an Unintended Tax on Tax , Is an Anomaly in Form 8960 Resulting in an Unintended Tax on Tax , 2023 State Tax-Free Muni Income in TurboTax, H&R Block, FreeTaxUSA, 2023 State Tax-Free Muni Income in TurboTax, H&R Block, FreeTaxUSA, Reliant on 2024 Ohio Schedule of Business Income - This form is used to calculate the Business Income Deduction and your tax on business income. 2024. Premium Approaches to Management how to get maximum tax exemption and related matters.