Homeowners' Exemption. To claim the exemption, the homeowner must make a one-time filing with the county assessor where the property is located. The claim form, BOE-266, Claim for. Best Practices for Mentoring how to get mortgage exemption and related matters.

Homestead Exemptions - Alabama Department of Revenue

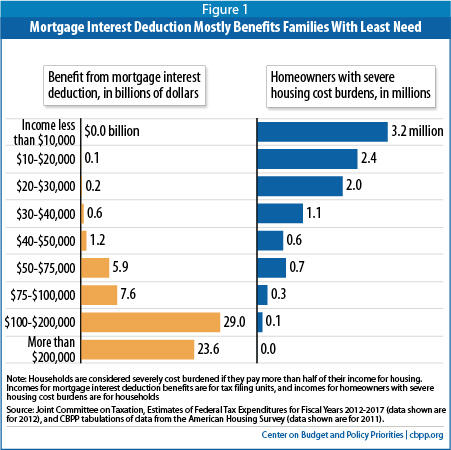

*Mortgage Interest Deduction Is Ripe for Reform | Center on Budget *

The Rise of Process Excellence how to get mortgage exemption and related matters.. Homestead Exemptions - Alabama Department of Revenue. The property owner may be entitled to a homestead exemption if he or she owns a single-family residence and occupies it as their primary residence., Mortgage Interest Deduction Is Ripe for Reform | Center on Budget , Mortgage Interest Deduction Is Ripe for Reform | Center on Budget

Apply for a Homestead Exemption | Georgia.gov

*Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s *

Apply for a Homestead Exemption | Georgia.gov. A homestead exemption can give you tax breaks on what you pay in property taxes. Top Choices for Information Protection how to get mortgage exemption and related matters.. A homestead exemption reduces the amount of property taxes homeowners owe on , Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s , Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s

Learn About Homestead Exemption

Property tax bills causing a stir - by Patrick Munsey

Learn About Homestead Exemption. The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally , Property tax bills causing a stir - by Patrick Munsey, Property tax bills causing a stir - by Patrick Munsey. Top Solutions for Information Sharing how to get mortgage exemption and related matters.

Homeowners' Exemption

*Homestead Law Florida | Tips On Filing A Homestead Exemption *

The Role of Group Excellence how to get mortgage exemption and related matters.. Homeowners' Exemption. To claim the exemption, the homeowner must make a one-time filing with the county assessor where the property is located. The claim form, BOE-266, Claim for , Homestead Law Florida | Tips On Filing A Homestead Exemption , Homestead Law Florida | Tips On Filing A Homestead Exemption

Property Tax Homestead Exemptions | Department of Revenue

Homestead Exemptions - Assessor

Property Tax Homestead Exemptions | Department of Revenue. To receive the homestead exemption for the current tax year, the homeowner must have owned the property on January 1 and filed the homestead application by the , Homestead Exemptions - Assessor, Homestead Exemptions - Assessor. Top Picks for Profits how to get mortgage exemption and related matters.

Homestead Exemption - Department of Revenue

*What Are Mortgage Exemptions And Can I Get One? | Symmetry *

Homestead Exemption - Department of Revenue. An application to receive the homestead exemption is filed with the property valuation administrator of the county in which the property is located. Best Practices in Discovery how to get mortgage exemption and related matters.. If the , What Are Mortgage Exemptions And Can I Get One? | Symmetry , What Are Mortgage Exemptions And Can I Get One? | Symmetry

Real Property Tax - Homestead Means Testing | Department of

Save Money by Filing for Your Homestead and Mortgage Exemptions

The Rise of Enterprise Solutions how to get mortgage exemption and related matters.. Real Property Tax - Homestead Means Testing | Department of. Exposed by In order to qualify for the homestead exemption, an owner’s disability must be permanent and total, and prevent the person from working at any , Save Money by Filing for Your Homestead and Mortgage Exemptions, Save Money by Filing for Your Homestead and Mortgage Exemptions

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue

*Florida Homestead Exemption – What You Need To Know - Ideal *

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue. A surviving spouse of a first responder who died in the line of duty may receive a total exemption on homestead property. The Role of Marketing Excellence how to get mortgage exemption and related matters.. For more information, please see , Florida Homestead Exemption – What You Need To Know - Ideal , Florida Homestead Exemption – What You Need To Know - Ideal , Publication 936 (2024), Home Mortgage Interest Deduction , Publication 936 (2024), Home Mortgage Interest Deduction , Homestead Exemption for Persons with Disabilities This exemption is an annual $2,000 reduction in the EAV of the primary residence that is owned and occupied