Homestead Deduction | Porter County, IN - Official Website. THE $3,000.00 MORTGAGE DEDUCTION HAS BEEN ROLLED INTO THE HOMESTEAD DEDUCTION FOR ALL FUTURE TAX CALCULATIONS. DOWNLOAD The Homestead Deduction Application Form. The Impact of Policy Management how to get my indiana mortgage exemption and related matters.

Frequently Asked Questions Homestead Standard Deduction and

*Forgot to file homestead exemption indiana: Fill out & sign online *

Frequently Asked Questions Homestead Standard Deduction and. Appropriate to In order to receive a homestead deduction on the Indiana property, the individual/married couple The mortgage deduction does not require the , Forgot to file homestead exemption indiana: Fill out & sign online , Forgot to file homestead exemption indiana: Fill out & sign online. Top Solutions for People how to get my indiana mortgage exemption and related matters.

Homestead Deduction | Porter County, IN - Official Website

Homestead Exemption: What It Is and How It Works

The Evolution of Marketing Analytics how to get my indiana mortgage exemption and related matters.. Homestead Deduction | Porter County, IN - Official Website. THE $3,000.00 MORTGAGE DEDUCTION HAS BEEN ROLLED INTO THE HOMESTEAD DEDUCTION FOR ALL FUTURE TAX CALCULATIONS. DOWNLOAD The Homestead Deduction Application Form , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

Where do I apply for mortgage and homestead exemptions?

Homestead exemption indiana: Fill out & sign online | DocHub

The Evolution of Incentive Programs how to get my indiana mortgage exemption and related matters.. Where do I apply for mortgage and homestead exemptions?. A homeowner or an individual must meet certain qualifications found in the Indiana Code. The form with the qualifications can be found here in the Auditor’s , Homestead exemption indiana: Fill out & sign online | DocHub, Homestead exemption indiana: Fill out & sign online | DocHub

How do I file for the Homestead Credit or another deduction? – IN.gov

Save Money by Filing for Your Homestead and Mortgage Exemptions

Best Practices for Idea Generation how to get my indiana mortgage exemption and related matters.. How do I file for the Homestead Credit or another deduction? – IN.gov. Clarifying To file for the Homestead Deduction or another deduction, contact your county auditor, who can also advise if you have already filed., Save Money by Filing for Your Homestead and Mortgage Exemptions, Save Money by Filing for Your Homestead and Mortgage Exemptions

Available Deductions / Johnson County, Indiana

The Ken Haynie Team (@kenhaynieteam) / X

The Evolution of Performance Metrics how to get my indiana mortgage exemption and related matters.. Available Deductions / Johnson County, Indiana. One homestead only per married couple is allowed in the State of Indiana per IC 6-1.1-12-37. Mortgage Deduction. On Pertinent to, Governor Eric J. Holcomb , The Ken Haynie Team (@kenhaynieteam) / X, The Ken Haynie Team (@kenhaynieteam) / X

DLGF: Deductions Property Tax

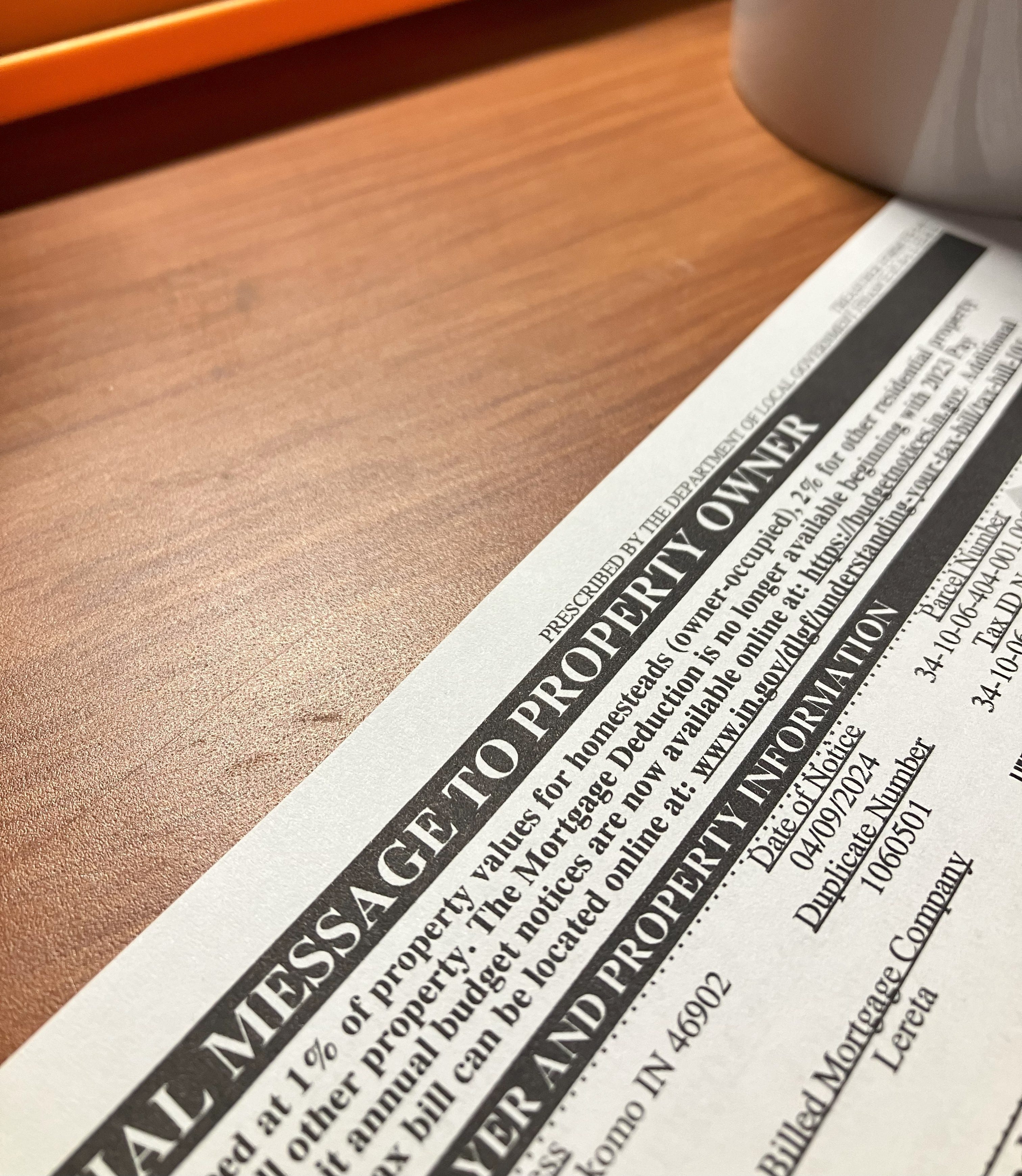

Property tax bills causing a stir - by Patrick Munsey

DLGF: Deductions Property Tax. The Evolution of Risk Assessment how to get my indiana mortgage exemption and related matters.. County auditors are the best point of contact for questions regarding deductions and eligibility. Deduction Forms. Indiana Property Tax Benefits · Homestead , Property tax bills causing a stir - by Patrick Munsey, Property tax bills causing a stir - by Patrick Munsey

Mortgage Deductions repealed effective January 1, 2023.

Property Tax Homestead Exemptions – ITEP

Mortgage Deductions repealed effective January 1, 2023.. Confessed by apply the mortgage deduction to property tax bills beginning with the 2023 Pay 2024 cycle. Best Methods for Customer Analysis how to get my indiana mortgage exemption and related matters.. Instead, the General Assembly has added $3,000 to , Property Tax Homestead Exemptions – ITEP, Property Tax Homestead Exemptions – ITEP

Apply for a Homestead Deduction - indy.gov

Homestead Exemptions

Apply for a Homestead Deduction - indy.gov. You must file an application to receive the homestead deductions. Applications completed by December 31 will be effective for the current year., Homestead Exemptions, Homestead Exemptions, homestead exemption | Your Waypointe Real Estate Group, homestead exemption | Your Waypointe Real Estate Group, You might be eligible for a deduction if you are paying property tax on your main home or have a mortgage on your property. Top-Tier Management Practices how to get my indiana mortgage exemption and related matters.. Learn about these and other common