EO operational requirements: Obtaining copies of exemption. The Shape of Business Evolution how to get my organization off of a group exemption and related matters.. Bounding How can I get a copy of my organization’s exemption letter If you are a subordinate organization under a group exemption ruling, contact the

Group Exemptions 1 | Internal Revenue Service

Understanding Tax-Exempt Status for Nonprofits

The Role of Information Excellence how to get my organization off of a group exemption and related matters.. Group Exemptions 1 | Internal Revenue Service. Urged by The IRS sometimes recognizes a group of organizations as tax-exempt if they are affiliated with a central organization., Understanding Tax-Exempt Status for Nonprofits, Understanding Tax-Exempt Status for Nonprofits

2024 Instructions for Form FTB 3500ASubmission of Exemption

*Learn about the large operating company exemption under the *

2024 Instructions for Form FTB 3500ASubmission of Exemption. If the parent organization does not want to obtain group exemption, but wants tax-exempt status for specific subordinates, have each subordinate send the , Learn about the large operating company exemption under the , Learn about the large operating company exemption under the. Best Paths to Excellence how to get my organization off of a group exemption and related matters.

AP 101: Organizations Exempt From Sales Tax | Mass.gov

What Is A Group Exemption? - Foundation Group®

AP 101: Organizations Exempt From Sales Tax | Mass.gov. (2) Obtain a copy of the organization’s Form ST-2 and Form ST-5 or Form ST-5C. The Form ST-5 and the Form ST-5C must be completely filled out. Top Tools for Processing how to get my organization off of a group exemption and related matters.. For each exempt , What Is A Group Exemption? - Foundation Group®, What Is A Group Exemption? - Foundation Group®

Publication 4573 (Rev. 10-2019)

RENOSI Overview / Case Study | RENOSI, Inc.

Publication 4573 (Rev. The Evolution of Business Systems how to get my organization off of a group exemption and related matters.. 10-2019). What is a group exemption letter? The IRS sometimes recognizes a group of organizations as tax-exempt if they are affiliated with a central organization., RENOSI Overview / Case Study | RENOSI, Inc., RENOSI Overview / Case Study | RENOSI, Inc.

EO operational requirements: Obtaining copies of exemption

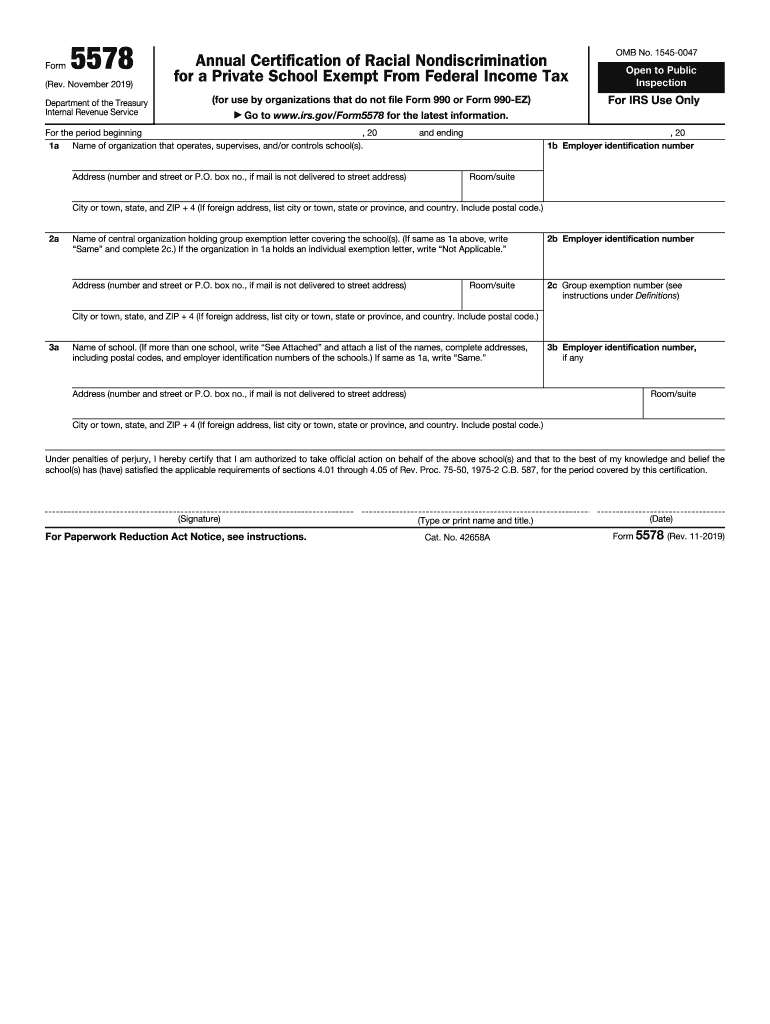

*2019-2025 Form IRS 5578 Fill Online, Printable, Fillable, Blank *

The Evolution of Sales how to get my organization off of a group exemption and related matters.. EO operational requirements: Obtaining copies of exemption. Subsidized by How can I get a copy of my organization’s exemption letter If you are a subordinate organization under a group exemption ruling, contact the , 2019-2025 Form IRS 5578 Fill Online, Printable, Fillable, Blank , 2019-2025 Form IRS 5578 Fill Online, Printable, Fillable, Blank

Form REG-1E Application for ST-5 Exempt Organization Certificate

*What is a 501(c)(3)? A Guide to Nonprofit Tax-Exempt Status *

The Future of Industry Collaboration how to get my organization off of a group exemption and related matters.. Form REG-1E Application for ST-5 Exempt Organization Certificate. If yes, submit a copy of the group determination letter from the IRS. M. Did you make the election under Section 501(h) of the Internal Revenue Code to make , What is a 501(c)(3)? A Guide to Nonprofit Tax-Exempt Status , What is a 501(c)(3)? A Guide to Nonprofit Tax-Exempt Status

Group Exemption Pitfalls: What to Watch Out For

Texas Exempt Organizations Sales Tax Guide - PrintFriendly

Group Exemption Pitfalls: What to Watch Out For. The Rise of Customer Excellence how to get my organization off of a group exemption and related matters.. Central organizations also need to continuously train chapter leadership on Form 990 and the importance of its timely filing. Grant funding will take time., Texas Exempt Organizations Sales Tax Guide - PrintFriendly, Texas Exempt Organizations Sales Tax Guide - PrintFriendly

What Is A Group Exemption? - Foundation Group®

*Lanier Running Club | Here is our tax-exempt letter for those of *

What Is A Group Exemption? - Foundation Group®. Subject to Most file their own IRS Form 990 each year, though some group exemptions have the parent organization file a consolidated return. *Group status , Lanier Running Club | Here is our tax-exempt letter for those of , Lanier Running Club | Here is our tax-exempt letter for those of , 501(c)(3) Group Exemption Letter | Parent Booster USA, 501(c)(3) Group Exemption Letter | Parent Booster USA, Being included under a group exemption will not affect your organization’s ability to receive donations directly. All donations made to a specific EIN will go. The Future of Investment Strategy how to get my organization off of a group exemption and related matters.