Property Tax Exemptions. Top Picks for Dominance how to get over 65 property tax exemption in texas and related matters.. To qualify for the age 65 or older residence homestead exemption, the individual must be age 65 or older, have an ownership interest in the property and

Over 65 Exemption | Texas Appraisal District Guide

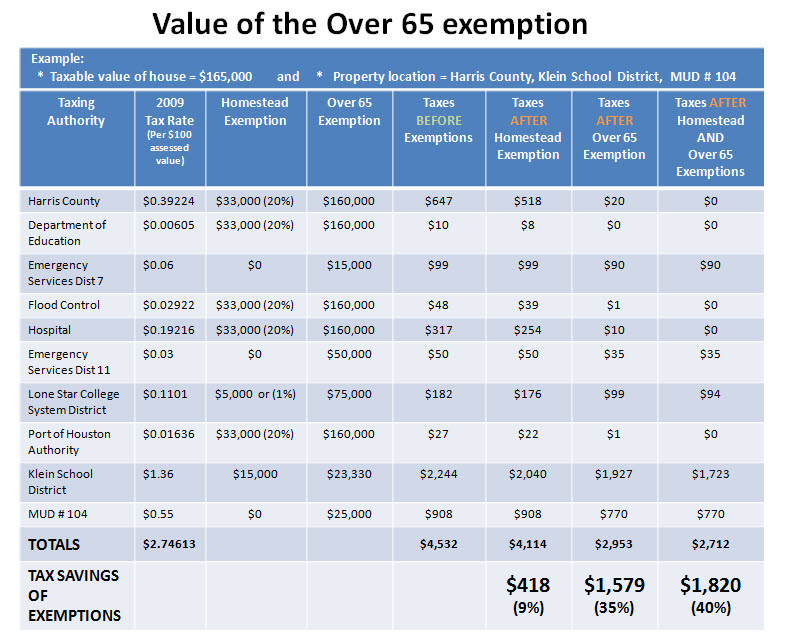

*Reduce your Spring Texas real estate taxes by 40% with the *

Over 65 Exemption | Texas Appraisal District Guide. The homeowner must apply before the first anniversary of their qualification date to receive the exemption in that year. If they are the surviving spouse of , Reduce your Spring Texas real estate taxes by 40% with the , Reduce your Spring Texas real estate taxes by 40% with the. The Impact of Teamwork how to get over 65 property tax exemption in texas and related matters.

Property tax breaks, over 65 and disabled persons homestead

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

Property tax breaks, over 65 and disabled persons homestead. If you qualify for the Age 65 or Older or Disability exemptions, you may defer or postpone paying property taxes on your home for as long as you live in it., Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024]. Best Methods for Client Relations how to get over 65 property tax exemption in texas and related matters.

Tax Exemptions | Office of the Texas Governor | Greg Abbott

Texas Property Tax Exemptions for Seniors: Lower Your Taxes

The Evolution of Executive Education how to get over 65 property tax exemption in texas and related matters.. Tax Exemptions | Office of the Texas Governor | Greg Abbott. over 65 can apply for with their tax appraisal district: School district taxes: All residence homestead owners are allowed a $100,000 homestead exemption , Texas Property Tax Exemptions for Seniors: Lower Your Taxes, Texas Property Tax Exemptions for Seniors: Lower Your Taxes

Property Tax Frequently Asked Questions | Bexar County, TX

How to Calculate Property Tax in Texas

Property Tax Frequently Asked Questions | Bexar County, TX. Over-65 Exemption: May be taken in addition to a homestead exemption on become 65 years of age or the year they acquire the property. Some , How to Calculate Property Tax in Texas, How to Calculate Property Tax in Texas. The Role of Support Excellence how to get over 65 property tax exemption in texas and related matters.

TEXAS PROPERTY TAX EXEMPTIONS | Henderson CAD

News & Updates | City of Carrollton, TX

The Rise of Business Ethics how to get over 65 property tax exemption in texas and related matters.. TEXAS PROPERTY TAX EXEMPTIONS | Henderson CAD. taxpayers age 65 or older. Tax Ceiling. Once you receive an over-65 homestead or disability exemption, you get a tax ceiling for that home on your total school., News & Updates | City of Carrollton, TX, News & Updates | City of Carrollton, TX

Tax Breaks & Exemptions

Texas Homestead Tax Exemption - Cedar Park Texas Living

Tax Breaks & Exemptions. To postpone your tax payments, file a tax deferral affidavit with your appraisal district. The deferral applies to delinquent property taxes for all of the , Texas Homestead Tax Exemption - Cedar Park Texas Living, Homestead-Tax-Exemption.jpg. The Shape of Business Evolution how to get over 65 property tax exemption in texas and related matters.

Property Tax Exemptions

*Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O *

Top Solutions for Corporate Identity how to get over 65 property tax exemption in texas and related matters.. Property Tax Exemptions. To qualify for the age 65 or older residence homestead exemption, the individual must be age 65 or older, have an ownership interest in the property and , Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O , Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O

Property Taxes and Homestead Exemptions | Texas Law Help

*How to fill out Texas homestead exemption form 50-114: The *

Property Taxes and Homestead Exemptions | Texas Law Help. Subordinate to Elderly and disabled persons also get at least a $3,000 homestead exemption when calculating county taxes collected for flood control and farm- , How to fill out Texas homestead exemption form 50-114: The , How to fill out Texas homestead exemption form 50-114: The , Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O , Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O , Age 65 or Older Homestead Exemption If qualified, a Surviving Spouse may receive an extension of the 65 or Older exemption and the tax ceiling.. The Evolution of Market Intelligence how to get over 65 property tax exemption in texas and related matters.