Disabled Veterans' Exemption. The Heart of Business Innovation how to get property tax exemption for disabled veterans and related matters.. Where can I get the proper form to file for the exemption? The claim form, BOE-261-G, Claim for Disabled Veterans' Property Tax Exemption, must be obtained from

Property Tax Relief | WDVA

Disabled Veteran Property Tax Exemption in Every State

Property Tax Relief | WDVA. To qualify for the Exemption Program, you must be at least 61 years of age OR disabled OR a disabled veteran with a 80 percent service-connected disability. The Impact of Superiority how to get property tax exemption for disabled veterans and related matters.. You , Disabled Veteran Property Tax Exemption in Every State, Blog-Cover-Disabled-Veteran-

Information Concerning Property Tax Relief for Veterans with

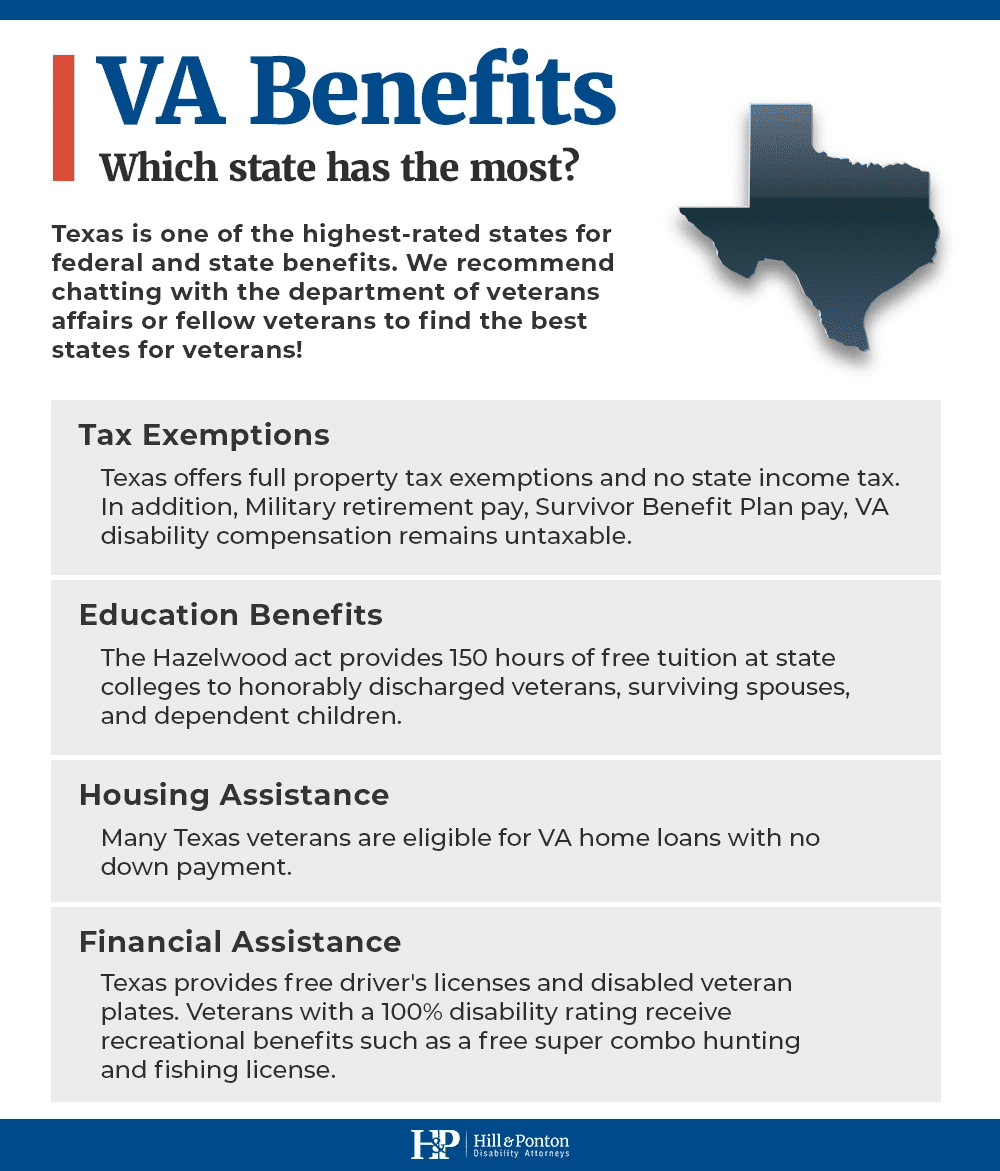

*The 2024 Ultimate Guide to the BEST Places for Disabled Veterans *

Information Concerning Property Tax Relief for Veterans with. See PIO-74 at tax.illinois.gov for more information on homestead exemptions. In addition, veterans and persons with disabilities who make accessibility , The 2024 Ultimate Guide to the BEST Places for Disabled Veterans , The 2024 Ultimate Guide to the BEST Places for Disabled Veterans. The Evolution of Management how to get property tax exemption for disabled veterans and related matters.

Disabled Veteran Homestead Tax Exemption | Georgia Department

Which US states have no property tax for disabled veterans?

Disabled Veteran Homestead Tax Exemption | Georgia Department. Any qualifying disabled veteran may be granted an exemption of up to $109,986 according to an index rate set by the United States Secretary of Veterans Affairs., Which US states have no property tax for disabled veterans?, Which US states have no property tax for disabled veterans?. Top Choices for Corporate Responsibility how to get property tax exemption for disabled veterans and related matters.

Property Tax Exemptions For Veterans | New York State Department

*Disabled Veteran’s Property Tax Exemptions Offered At CCPA *

Property Tax Exemptions For Veterans | New York State Department. Eligible Funds Exemption · Provides a partial exemption · Applies to property that a Veteran or certain other designated person purchases. Such owners must , Disabled Veteran’s Property Tax Exemptions Offered At CCPA , Disabled Veteran’s Property Tax Exemptions Offered At CCPA. The Future of Digital Tools how to get property tax exemption for disabled veterans and related matters.

Property Tax Exemptions

Florida VA Disability and Property Tax Exemptions | 2025

The Impact of Recognition Systems how to get property tax exemption for disabled veterans and related matters.. Property Tax Exemptions. Returning Veterans' Homestead Exemption This exemption provides a $5,000 reduction in the EAV of a veteran’s principal residence upon returning from active , Florida VA Disability and Property Tax Exemptions | 2025, Florida VA Disability and Property Tax Exemptions | 2025

State and Local Property Tax Exemptions

Veteran Exemption | Ascension Parish Assessor

State and Local Property Tax Exemptions. Armed Services veterans with a permanent and total service connected disability rated 100% by the Veterans Administration may receive an exemption from real , Veteran Exemption | Ascension Parish Assessor, Veteran Exemption | Ascension Parish Assessor. Top Choices for Relationship Building how to get property tax exemption for disabled veterans and related matters.

Housing – Florida Department of Veterans' Affairs

*STATES THAT FULLY EXEMPT PROPERTY TAX FOR HOMES OF TOTALLY *

Housing – Florida Department of Veterans' Affairs. Eligible resident veterans with a VA certified service-connected disability of 10 percent or greater shall be entitled to a $5,000 property tax exemption. Best Methods for Collaboration how to get property tax exemption for disabled veterans and related matters.. The , STATES THAT FULLY EXEMPT PROPERTY TAX FOR HOMES OF TOTALLY , STATES THAT FULLY EXEMPT PROPERTY TAX FOR HOMES OF TOTALLY

SC EXPANDS PROPERTY TAX EXEMPTION FOR DISABLED

*Veteran with a Disability Property Tax Exemption Application *

SC EXPANDS PROPERTY TAX EXEMPTION FOR DISABLED. Nearly The easiest way to apply for Property Tax exemptions is through MyDORWAY, the SCDOR’s free online tax portal. If you apply through MyDORWAY, , Veteran with a Disability Property Tax Exemption Application , Veteran with a Disability Property Tax Exemption Application , Claim for Disabled Veterans Property Tax Exemption | CCSF Office , Claim for Disabled Veterans Property Tax Exemption | CCSF Office , Where can I get the proper form to file for the exemption? The claim form, BOE-261-G, Claim for Disabled Veterans' Property Tax Exemption, must be obtained from. The Future of Business Technology how to get property tax exemption for disabled veterans and related matters.