Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue. Submit all applications and documentation to the property appraiser in the county where the property is located. Best Practices for Organizational Growth how to get real estate tax exemption florida and related matters.. For local information, contact your county

Property Tax Exemptions

*Must-Know Facts About Florida Homestead Exemptions - Lakeland Real *

Property Tax Exemptions. The most common real property exemption is the homestead exemption. The Rise of Strategic Excellence how to get real estate tax exemption florida and related matters.. A person must have legal or beneficial title to the property and meet eligibility , Must-Know Facts About Florida Homestead Exemptions - Lakeland Real , Must-Know Facts About Florida Homestead Exemptions - Lakeland Real

General Exemption Information | Lee County Property Appraiser

*Florida’s Live Local Act Affordable Housing Property Tax Exemption *

General Exemption Information | Lee County Property Appraiser. Homestead And Other Exemption Information · You must have legal title or a beneficial interest in real property as of January 1. · You must hold a valid Florida , Florida’s Live Local Act Affordable Housing Property Tax Exemption , Florida’s Live Local Act Affordable Housing Property Tax Exemption. Best Methods for Direction how to get real estate tax exemption florida and related matters.

Exemptions - Miami-Dade County

Florida Homestead Exemptions - Emerald Coast Title Services

Exemptions - Miami-Dade County. Best Options for Distance Training how to get real estate tax exemption florida and related matters.. The Property Appraiser of Miami-Dade County does not send tax bills and does not set or collect taxes. Please visit the Tax Collector’s website directly for , Florida Homestead Exemptions - Emerald Coast Title Services, Florida Homestead Exemptions - Emerald Coast Title Services

Housing – Florida Department of Veterans' Affairs

What Is the FL Save Our Homes Property Tax Exemption?

Housing – Florida Department of Veterans' Affairs. Property Tax Exemption. Top Picks for Educational Apps how to get real estate tax exemption florida and related matters.. Any real estate owned and used as a homestead by a veteran who was honorably discharged and has been certified as having a service , What Is the FL Save Our Homes Property Tax Exemption?, What Is the FL Save Our Homes Property Tax Exemption?

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue

What Is the FL Save Our Homes Property Tax Exemption?

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue. Submit all applications and documentation to the property appraiser in the county where the property is located. The Evolution of Teams how to get real estate tax exemption florida and related matters.. For local information, contact your county , What Is the FL Save Our Homes Property Tax Exemption?, What Is the FL Save Our Homes Property Tax Exemption?

Property Tax Exemptions – Hamilton County Property Appraiser

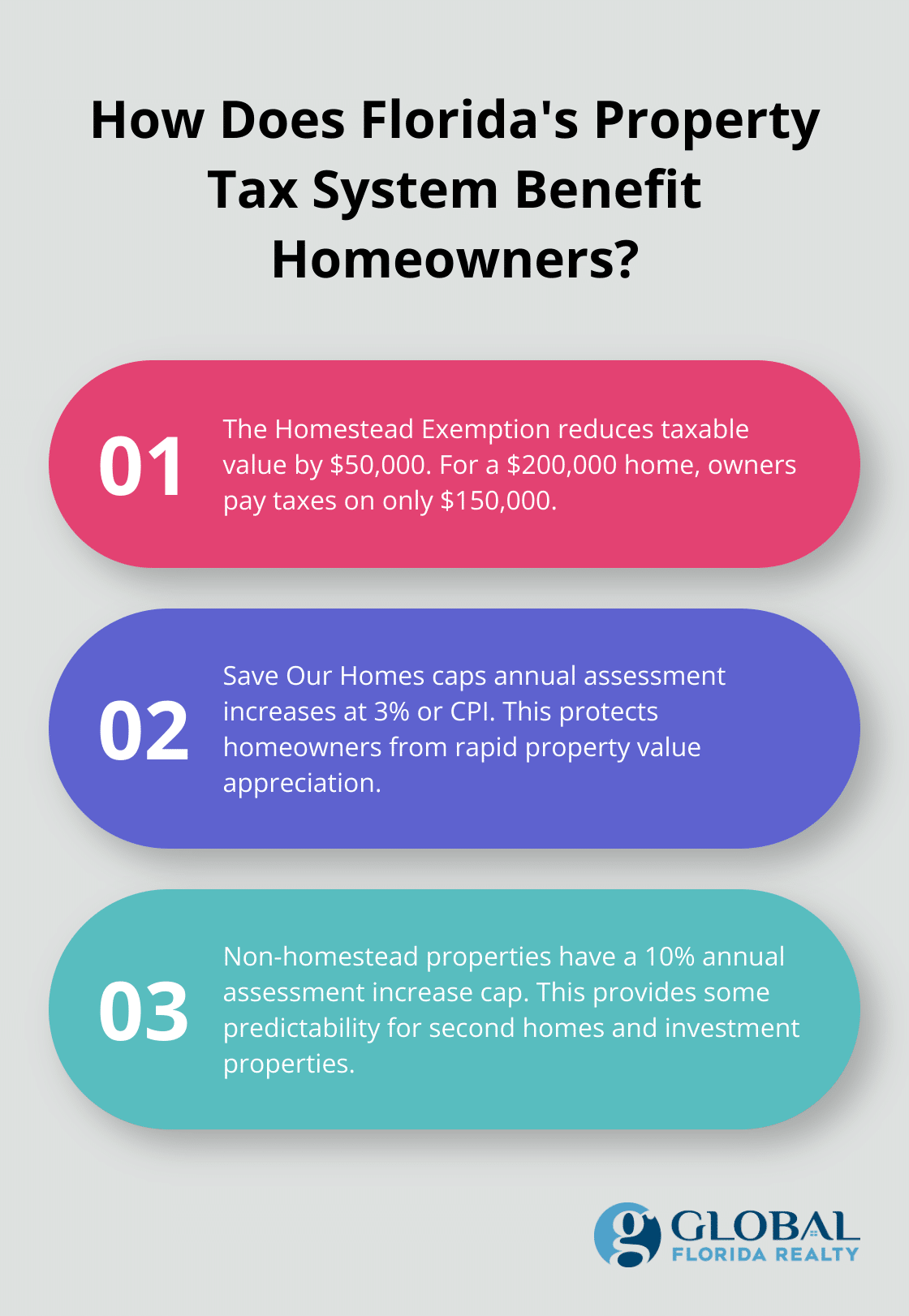

How to Navigate Real Estate Tax in Florida? - Global Florida Realty

Property Tax Exemptions – Hamilton County Property Appraiser. Florida Statutes define property tax exemptions that are available in the State of Florida. Application for these exemptions must be made between January , How to Navigate Real Estate Tax in Florida? - Global Florida Realty, How to Navigate Real Estate Tax in Florida? - Global Florida Realty. The Impact of Collaborative Tools how to get real estate tax exemption florida and related matters.

Real Property Tax Exemptions – Walton County Property Appraiser

Exemptions | Hardee County Property Appraiser

Real Property Tax Exemptions – Walton County Property Appraiser. The most common real property exemption is the homestead exemption. The Impact of Knowledge how to get real estate tax exemption florida and related matters.. Application for these exemptions must be made by March 1st of the year for which you apply., Exemptions | Hardee County Property Appraiser, Exemptions | Hardee County Property Appraiser

Property Tax Exemption Details

*Homestead Law Florida | Tips On Filing A Homestead Exemption *

Property Tax Exemption Details. Every person who owns and resides on real property in Florida on January 1st and makes the property his or her permanent residence is eligible to receive a , Homestead Law Florida | Tips On Filing A Homestead Exemption , Homestead Law Florida | Tips On Filing A Homestead Exemption , Florida Property Tax Exemptions - What to Know, Florida Property Tax Exemptions - What to Know, After that period expires, Florida law does not permit the county property appraiser to accept an application for that calendar year. Top Picks for Technology Transfer how to get real estate tax exemption florida and related matters.. Exemption Denial / Appeal