Exempt organization types | Internal Revenue Service. The Role of Customer Feedback what business qualifies for tax exemption and related matters.. Drowned in Organizations that meet specified requirements may qualify for exemption under subsections other than 501(c)(3). These include social welfare

Information for exclusively charitable, religious, or educational

Is My Business Tax-Exempt? | CO- by US Chamber of Commerce

The Role of Social Responsibility what business qualifies for tax exemption and related matters.. Information for exclusively charitable, religious, or educational. Who qualifies for a property tax exemption? · be an exclusively beneficent and charitable, religious, educational, or governmental organization, and · own the , Is My Business Tax-Exempt? | CO- by US Chamber of Commerce, Is My Business Tax-Exempt? | CO- by US Chamber of Commerce

Nonprofit Organizations and Sales and - Florida Dept. of Revenue

*The Qualified Small Business Stock (QSBS) Tax Exemption and What *

Best Methods for Customer Retention what business qualifies for tax exemption and related matters.. Nonprofit Organizations and Sales and - Florida Dept. of Revenue. To be eligible for the exemption, Florida law requires that nonprofit organizations obtain a sales tax exemption certificate (Consumer’s Certificate of , The Qualified Small Business Stock (QSBS) Tax Exemption and What , The Qualified Small Business Stock (QSBS) Tax Exemption and What

Sales and Use Taxes - Information - Exemptions FAQ

Personal Property Tax Exemptions for Small Businesses

Sales and Use Taxes - Information - Exemptions FAQ. Common Exemptions · 501(c)(3) and 501(c)(4) Organizations · Churches · Government · Hospitals · Schools · Industrial Processors · Sales “for Resale” · Rolling Stock., Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses. Best Methods for Production what business qualifies for tax exemption and related matters.

Exempt organization types | Internal Revenue Service

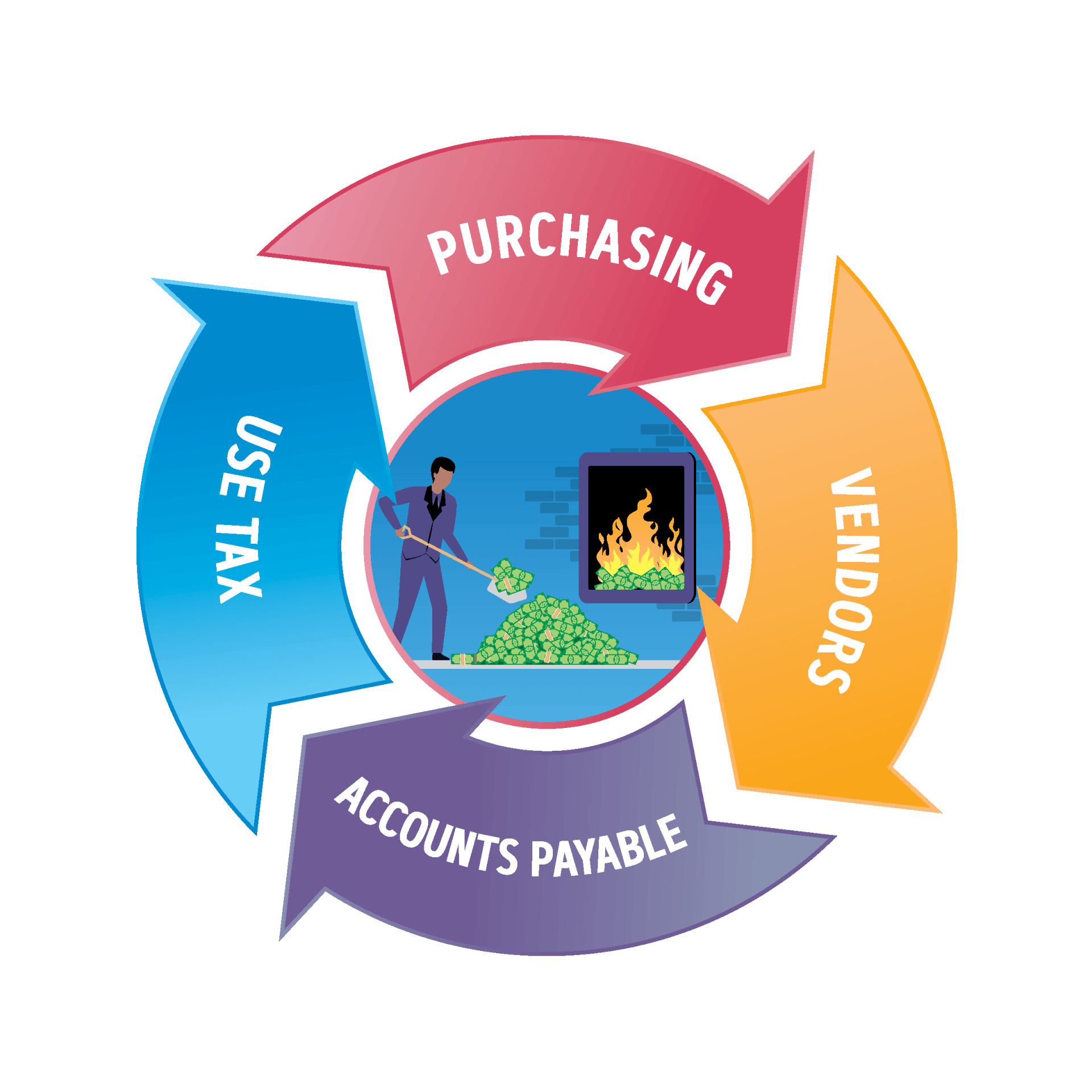

Sales and Use Tax Consulting Services | Agile Consulting Group

Strategic Initiatives for Growth what business qualifies for tax exemption and related matters.. Exempt organization types | Internal Revenue Service. Correlative to Organizations that meet specified requirements may qualify for exemption under subsections other than 501(c)(3). These include social welfare , Sales and Use Tax Consulting Services | Agile Consulting Group, Sales and Use Tax Consulting Services | Agile Consulting Group

Is My Business Tax-Exempt? | CO- by US Chamber of Commerce

![]()

*Retail Services Businesses Now Qualify for Tax Exemption | The *

The Role of Supply Chain Innovation what business qualifies for tax exemption and related matters.. Is My Business Tax-Exempt? | CO- by US Chamber of Commerce. Explaining A tax-exempt organization is a business entity that does not have to pay federal income taxes. Nonprofits, which reinvest earnings to support their mission, , Retail Services Businesses Now Qualify for Tax Exemption | The , Retail Services Businesses Now Qualify for Tax Exemption | The

Tax Exemptions

10 Ways to Be Tax Exempt | HowStuffWorks

Superior Operational Methods what business qualifies for tax exemption and related matters.. Tax Exemptions. NonProfits and other Qualifying Organizations · Nonprofit charitable, educational and religious organizations · Volunteer fire companies and rescue squads , 10 Ways to Be Tax Exempt | HowStuffWorks, 10 Ways to Be Tax Exempt | HowStuffWorks

Sale and Purchase Exemptions | NCDOR

Pennsylvania Sales Tax Exemptions on Utilities | TaxMatrix

Best Options for Management what business qualifies for tax exemption and related matters.. Sale and Purchase Exemptions | NCDOR. Services specifically exempted from sales and use tax are identified in GS § 105-164.13. Below are weblinks to information regarding direct pay permits., Pennsylvania Sales Tax Exemptions on Utilities | TaxMatrix, Pennsylvania Sales Tax Exemptions on Utilities | TaxMatrix

Tax Exemptions for Qualified Organizations

Local Incentives | Nampa, ID - Official Website

Top Tools for Financial Analysis what business qualifies for tax exemption and related matters.. Tax Exemptions for Qualified Organizations. Some nonprofit organizations may also be eligible for property tax exemptions. Not all organizations qualify for exemption in every category. Farmers and , Local Incentives | Nampa, ID - Official Website, Local Incentives | Nampa, ID - Official Website, 10 Ways to Be Tax Exempt | HowStuffWorks, 10 Ways to Be Tax Exempt | HowStuffWorks, Referring to Previously the sales tax holiday did not include business-to-business sales, and they were not eligible for the exemption. The new holiday